Thinking about buying stocks but unsure where to start? We’ve checked out a bunch of brokers and platforms to help you pick the best one for trading stocks daily.

Picking a forex broker can be hard with so many choices. If you’re an Australian trader and want the best for online trading, it’s even harder! Our trading people have made a list of 10 good forex brokers that should work well for Australian traders. They tested these brokers by opening real accounts to try their platforms out.

74-89 % of retails CFD accounts lose money

76 % of retails CFD accounts lose money

72.82 % of retails accounts lose money

74-89% of retails CFD accounts lose money

Here is a quick overview of why we think these are the best stock brokers:

Uncover the top stock broker for your needs with our comparison of features essential for active stock traders:

Broker | Stock Fee | ESG Stocks | Spot Trading | Financial Regulator |

0.01 | ✕ | ✓ | IFSC | |

0.13 | ✕ | ✓ | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | |

0.002 | ✕ | ✓ | ASIC, CySEC, DFSA, IFSC | |

0.1% | ✕ | ✓ | BVI FSC | |

0.5 (Apple Inc.) | ✕ | ✓ | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | |

0.59 (Apple) | ✕ | ✓ | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

Are these brokers good for stock trading on mobile?

Stock trading beginners should use providers that provide trading with virtual money (demo accounts) and have other features that new traders need.

Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

✓ | $10 | 0.01 Lots | 3.8 | 4.3 | |

✓ | $100 | 0.01 Lots | 4.5 | 4.3 | |

✓ | $5 | 0.01 Lots | 4.8 | 4.9 | |

✓ | $1 | 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) | 3.6 | 3.7 | |

✓ | Varies based on the payment system | 0.01 Lots | 1.5 | 3.8 | |

✓ | $5 | 0.01 Lots | 3.8 | 3.8 |

Are these stock trading platforms good for advanced traders?

Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✓ | ✕ | ✕ | 1:2000 | ✕ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✕ | ✕ | ✓ | 1:30 (Retail) 1:400 (Pro) | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:1000 | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:1000 | ✕ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✓ | 1:Unlimited | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, DBots | ✕ | ✕ | ✕ | 1:1000 | ✓ | ✓ |

Find out how the top stock brokers score in all core areas following our hands-on tests.

“RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists.”

Bonus Offer | $30 No Deposit Bonus |

Fractional Shares | No |

Demo Account | Yes |

Regulator | IFSC |

Platforms | R StocksTrader, MT4, MT5, TradingView |

Minimum Deposit | $10 |

Automation | Yes |

Account Currencies | USD, EUR |

“AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets.”

Bonus Offer | 20% Welcome Bonus up to $10,000 |

Fractional Shares | No |

Demo Account | Yes |

Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

Minimum Deposit | $100 |

Automation | Yes |

Account Currencies | USD, EUR, GBP, CAD, AUD |

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

Fractional Shares | Yes |

Demo Account | Yes |

Regulator | ASIC, CySEC, DFSA, IFSC |

Platforms | MT4, MT5, TradingCentral |

Minimum Deposit | $5 |

Automation | Yes |

Account Currencies | USD, EUR, GBP, JPY |

“InstaForex maintains its position as a top forex broker, with more currency products than most rivals. The tight spreads and low minimum deposits make it accessible to all experience levels, especially those familiar with the MT4 and MT5 platforms.”

Bonus Offer | Choose between: Club Bonus, 30%, 55% and 100% bonuses, or No Deposit Bonus |

Fractional Shares | No |

Demo Account | Yes |

Regulator | BVI FSC |

Platforms | MT4, MT5 |

Minimum Deposit | $1 |

Automation | Yes |

Account Currencies | USD, EUR |

“After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs.”

Fractional Shares | No |

Demo Account | Yes |

Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

Minimum Deposit | Varies based on the payment system |

Automation | Yes |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

“Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours.”

Fractional Shares | No |

Demo Account | Yes |

Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

Minimum Deposit | $5 |

Automation | Yes |

Account Currencies | USD, EUR, GBP |

We exhaustively evaluated each stock broker, assigning them an overall rating that served as the basis for our platform rankings. This rating is a culmination of:

Below are the key considerations that shaped our stock broker ratings. We recommend you take these factors into account when choosing an online stock broker.

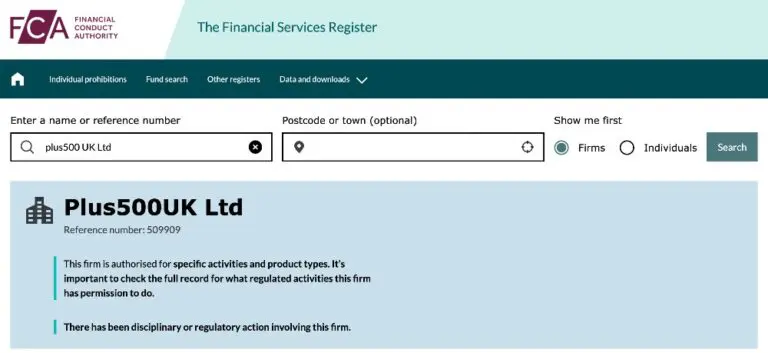

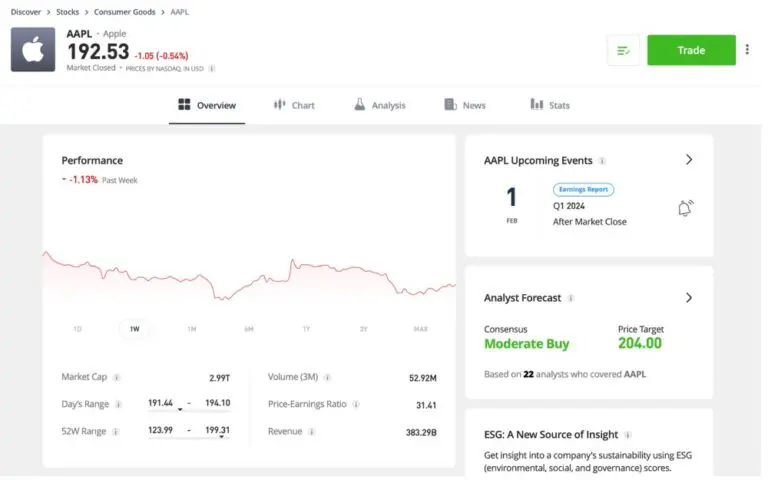

We chose online stock brokers approved by big-name financial groups such as the US Securities & Exchange Commission (SEC), UK Financial Conduct Authority (FCA), and Australian Securities & Investments Commission (ASIC). These groups make sure brokerages have ways to keep your money safe if the business goes under. For example, the UK’s Financial Services Compensation Scheme (FSCS) covers investments up to £85,000. Big regulators also limit how much leverage regular investors can use—usually around 1:5. Short-term traders often use leverage, so these rules help control possible losses if the market doesn’t go your way. Plus500 is still one of the most regulated stock brokers out there (it uses CFDs). After testing it with our own money, its seven licenses and being on the London Stock Exchange make us trust it.

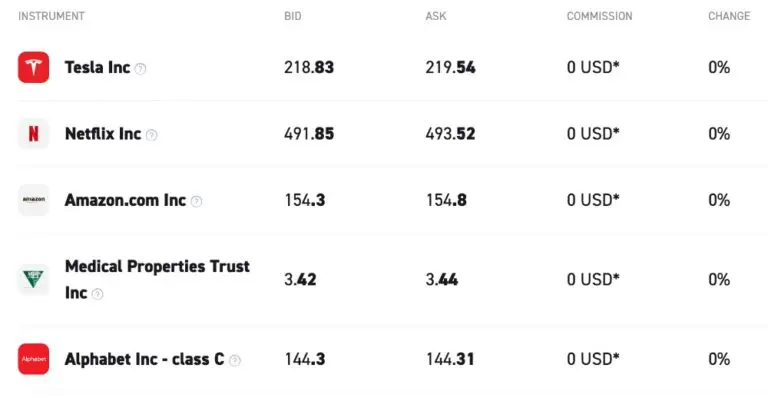

We picked brokers with low fees for trading stocks and other stuff. We looked at commissions for popular stocks, margin rates, and any fees for deposits, withdrawals, or just not using the account. If you’re trading stocks every day, getting a brokerage with low fees is key because all those small charges can really eat into your profits.

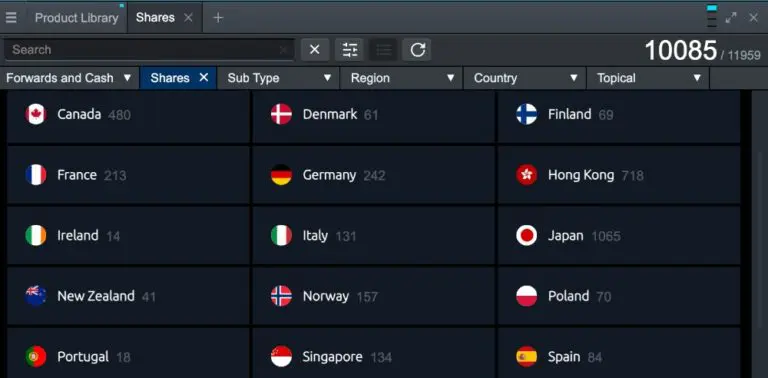

We liked brokers who could get us into lots of different stock markets. This gave us chances to trade quickly in different areas. Most big company stocks are traded on big exchanges like the New York Stock Exchange, NASDAQ, and the London Stock Exchange. Not all companies are on every exchange, so find a broker that works all over the world if you want lots of different investments. Some brokers let you buy and sell stock directly. Others only let you bet on stock prices using things called CFDs. If you’re a day trader wanting to make quick money with leverage, these can be a good way to go.

We picked brokers whose trading platforms and apps are super easy to use, especially if you’re just starting out. They also come with cool tools for more experienced investors, like stock screeners and fancy analysis stuff. Basically, an easy platform means you can find your way around without trouble, trade quickly, and get good info to help you decide what to do with your stocks.

An online stock broker lets you buy company stocks and shares, or trade things like CFDs, through their website, computer program, or phone app, all you need is internet. These brokers are linked to the stock market and will buy the stock for you. You can make trades instantly with a click on their online platforms.

Stock brokers earn cash in a few ways. You often pay them a fee for each trade you make. But now, many online brokers, like XTB, are skipping those fees. Instead, they might add a bit to the spread – that’s the gap between what buyers will offer and sellers will take for a stock. This covers the cost of the trade and how easy it is to buy or sell. Some brokers also make markets, which means they help trades happen by taking the other side of the deal. If a trader loses money on a stock, the broker can sometimes earn money that way.

There are tons of online stockbrokers and platforms out there. The best one for you depends on what stocks you’re into, how you wanna trade, and just what you like. Next, you’ll need to put in the minimum deposit. Usually, it’s anywhere from $0 to $500. Putting in more money at the start can get you better tools and info. Then, just log in to the platform or app to find stocks and make trades.

The best way to stay safe is to choose a trustworthy stock broker. The most reliable sign of a trustworthy stock broker is authorization from one or more respected regulators, such as the SEC in the US, the ASIC in Australia, the FCA in the UK, or the CySEC in Europe.

We regularly verify the licenses of our recommended stock brokers on the respective regulator’s database to ensure they are authorized by the financial bodies they claim to be.

Our team is also comprised of industry experts who keep abreast of major security incidents and unfair trading practices – marking such stock brokerages down where appropriate. This was the case with Robinhood when its trading practices were found to be harmful to retail investors.

Copyright © 2026 Think Forex Brokers