Check out our list of top CFD brokers with awesome trading platforms. Our research team tests every CFD provider we suggest, so they all get high scores and our experts trust them.

In August 2025 we have reviewed 227 brokers and our hands-on tests show that these are the 6 best CFD brokers in Pakistan:

74-89 % of retails CFD accounts lose money

73.85 % of retails CFD accounts lose money

72.82 % of retails accounts lose money

70.64 % of retails investor accounts lose money

Here is a short summary of why we think these are the best CFD brokers:

Find the best CFD broker for you based on our comparison of key features important to CFD traders:

Broker | Minimum Deposit | Leverage | Platforms | Regulators |

Varies based on the payment system | 1:Unlimited | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | |

$10 | 1:2000 | R StocksTrader, MT4, MT5, TradingView | IFSC | |

$5 | 1:1000 | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA | |

$100 | 1:30 (Retail) 1:400 (Pro) | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | |

$5 | 1:1000 | MT4, MT5, TradingCentral | ASIC, CySEC, DFSA, IFSC | |

$200 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | ASIC, CySEC, FSA, CMA |

Are these brokers good for mobile CFD Trading?

CFD trading beginners should use brokers that allow trading with virtual money (a demo account) and have other features that new traders need:

Experienced CFD traders should look for sophisticated tools to enhance the trading experience:

Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✓ | 1:Unlimited | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✓ | ✕ | ✕ | 1:2000 | ✕ | ✕ | |

Expert Advisors (EAs) on MetaTrader, DBots | ✕ | ✕ | ✕ | 1:1000 | ✓ | ✓ | |

Expert Advisors (EAs) on MetaTrader | ✕ | ✕ | ✓ | 1:30 (Retail) 1:400 (Pro) | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:1000 | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✓ | ✕ | ✕ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✓ | ✕ |

See how the top CFD brokers compare in all key areas according to our hands-on tests:

The cost of trading with a CFD broker will make a big difference over time. Here’s how the top CFD providers stack up on costs:

“Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours.”

FTSE Spread | 15.2 |

GBPUSD Spread | 0.0 |

Stocks Spread | 0.5 (Apple Inc.) |

Leverage | 1:Unlimited |

Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

“RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists.”

Bonus Offer | $30 No Deposit Bonus |

GBPUSD Spread | 0.4 |

Stocks Spread | 0.01 |

Leverage | 1:2000 |

Regulator | IFSC |

Platforms | R StocksTrader, MT4, MT5, TradingView |

Account Currencies | USD, EUR |

“Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours.”

FTSE Spread | 1.28 |

GBPUSD Spread | 1.4 |

Stocks Spread | 0.59 (Apple) |

Leverage | 1:1000 |

Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

Account Currencies | USD, EUR, GBP |

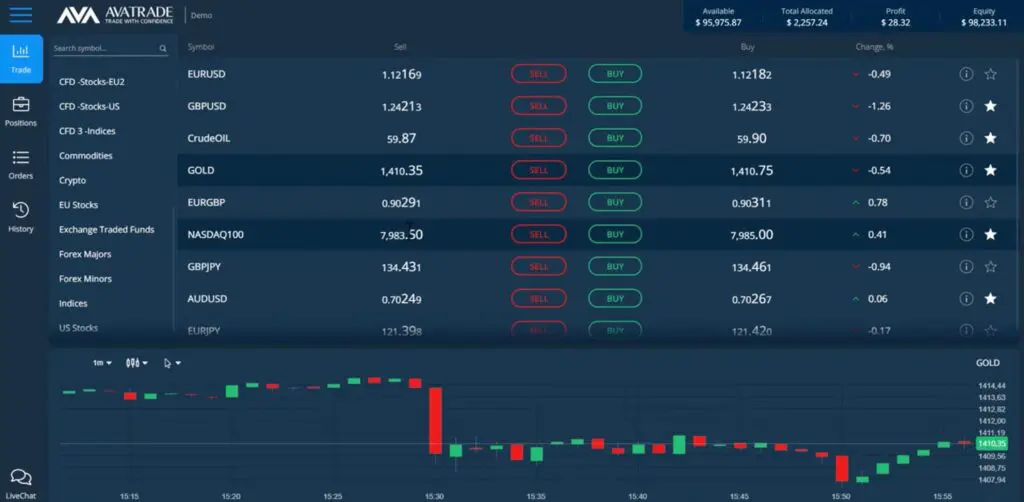

“AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets.”

Bonus Offer | 20% Welcome Bonus up to $10,000 |

FTSE Spread | 0.5 |

GBPUSD Spread | 1.5 |

Stocks Spread | 0.13 |

Leverage | 1:30 (Retail) 1:400 (Pro) |

Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

Account Currencies | USD, EUR, GBP, CAD, AUD |

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

FTSE Spread | 1.4 |

GBPUSD Spread | 0.8 |

Stocks Spread | 0.002 |

Leverage | 1:1000 |

Regulator | ASIC, CySEC, DFSA, IFSC |

Platforms | MT4, MT5, TradingCentral |

Account Currencies | USD, EUR, GBP, JPY |

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

FTSE Spread | 1.0 |

GBPUSD Spread | 0.23 |

Stocks Spread | 0.02 |

Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

Regulator | ASIC, CySEC, FSA, CMA |

Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

CFDs are super risky and tons of online brokers offer them. But, you can’t trust everyone and their trading terms are all over the place. That’s why we (and you!) need to check out a few things to find a CFD provider that fits what you’re after.

If you pick the wrong broker, you could get scammed or your business might fail. A broker called EverFX seemed okay, but in 2023, they were running a scam. Their account managers pushed traders to put their money into risky places that weren’t watched over. People ended up with almost no protection. A good sign that you can trust a CFD broker is if a high-level regulator like the UK Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC), or Cyprus Securities & Exchange Commission (CySEC) is watching over them.

We look at each CFD broker’s licenses to be sure they’re really allowed to do what they say they can. We also put each broker through its paces, watching out for any shady stuff. We only suggest brokers our own experts trust. They’ve checked out tons of brokers over the years. Plus500 gets a great trust score of 4.9/5. That’s because big-name regulators like the FCA, ASIC, and CySEC keep an eye on them. They are on the London Stock Exchange, have been around for 15+ years, are open about how they do business, and have a great name.

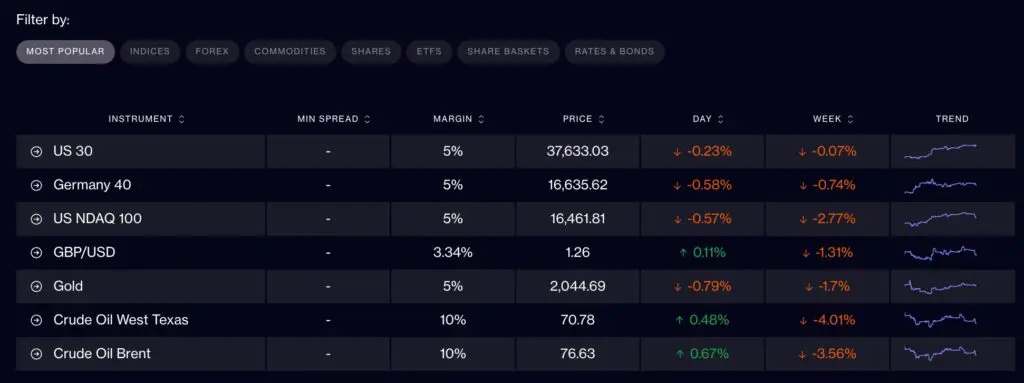

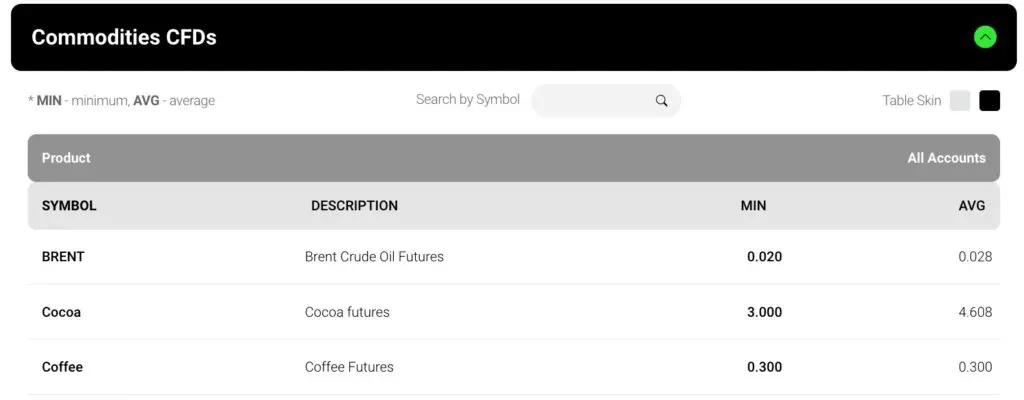

Picking a CFD broker that lets you trade the markets you’re interested in is super important. CFDs are cool since they let you trade lots of stuff like stocks, currencies, commodities, and crypto. So, we look for brokers that give traders enough options to spread their investments around.

When selecting a CFD broker, be sure to look at their fees because if you’re an active trader, those costs can really add up and eat into your earnings. Most CFD platforms profit through something called spreads. This is the difference between the price you can buy at and the price you can sell at, compared to the real market prices. It’s basically a little extra charge the broker adds. Fees can also be charged as commissions, where they take a small percentage of each trade you make. Fortunately, many good CFD brokers are getting rid of these commissions to stay competitive. CFD brokers also profit through financing. When you trade with margin or leverage, you’re actually borrowing money from the brokerage to trade bigger. Most firms have a fee for allowing you to do this.

Each year, we keep an eye on the trading fees of our best CFD brokers. We want to make sure they stay competitive by keeping their spreads tight and commissions low or even non-existent. We also check out all the fees, like those for deposits, withdrawals, and when you’re not active, and compare them with what you get overall. This includes access to markets and trading tools. Getting good value is more important than just having the lowest fees. IC Markets is usually one of the cheapest CFD brokers we see. The Standard account is good if you’re starting out. It has CFDs without commission and spreads from 0.8 pips. The Raw account is better if you know your way around trading; it has spreads from 0.0 and a small commission of $3.50, plus discounts if you trade a lot.

Since CFDs and similar stuff can be super risky and you could lose a lot, make sure you pick a broker that’s upfront about how leverage and margin work. Basically, leverage lets you trade with more money than you actually have, which can boost your profits big time, even if you don’t put down much cash to begin with. It’s usually shown as a ratio, like 1:10. So, if you put in $100, you’re trading as if you had $1,000 ($100 x 10).

The amount of leverage you get from CFD providers can change a lot. If your broker is watched over by a big regulator such as the FCA, ASIC, or CySEC, it’s probably going to be capped at 1:30 for forex. It could be even lower for things that jump around a lot, like crypto. These regulators also make sure CFD brokers protect you from losing more money than you have in your account. Even with those protections in place, some traders still pick offshore CFD brokers. They think it’s worth it because they want more leverage. Sometimes, it goes as high as 1:3000.

It’s important to pick a broker who has a CFD trading platform that’s easy to use and has the tools you want for looking at the markets. From what we’ve seen, the best CFD providers have popular programs like MetaTrader 4. It’s really useful if you’re an experienced trader into technical stuff and automated trading. They also have their own simple platforms and phone apps that are easy for beginners to understand.

With lots of CFD brokers having good deals these days, thinking about the extra stuff they offer can really help you pick one that fits your trading style and how much you know. The top CFD companies usually have some cool extras to help traders do well. Things like easy-to-understand training stuff and social platforms can guide newbie traders. Tools for checking out the market, like Trading Central, can help you find good trades. Also, VPS hosting gives experienced day traders super-fast trade speeds.

A CFD broker is a financial intermediary that enables you to speculate on price movements in various financial markets without owning the underlying assets.

They facilitate the trading process through an online platform. You sign up for an account, deposit funds, trade CFD products and then withdraw any profits.

CFDs are legal financial instruments that are tightly regulated in many jurisdictions. That said, brokers are banned from offering CFDs in some countries, including the United States.

Copyright © 2025 Think Forex Brokers