Crypto brokers can make trading stuff like Bitcoin feel safer than using exchanges. After the bankruptcies and scandals, you might feel better going with a broker. To find the best ones, we looked at a bunch of platforms, thinking about:

Our exhaustive reviews show that these are the 6 top crypto brokers and trading platforms in August 2025. Every cryptocurrency broker listed we assessed using either a real money or test account.

Here’s a fast overview of why these crypto brokers topped our rankings:

Uncover the top crypto broker for you with our comparison of the factors critical to crypto traders:

Broker | Bitcoin Trading | Crypto Spread | Crypto App | Minimum Deposit |

✓ | BTC <1%, ETH 2% | iOS & Android | $100 | |

✓ | From 0.5 | iOS & Android | $5 | |

✓ | Floating | iOS & Android | Varies based on the payment system | |

✓ | 0.05% BTC, 0.05% ETH | iOS & Android | $0 | |

✓ | Variable | iOS, Android & Windows | $5 | |

✓ | $12 (BTC) | iOS & Android | $100 |

The industry has been plagued with scandals, so check how our top crypto brokers safeguard your investments:

Are these brokers good for trading crypto on mobile?

Beginners should use firms that allow crypto trading with virtual money, alongside other features for novice investors:

Experienced crypto traders need powerful tools to elevate the trading experience:

Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

Expert Advisors (EAs) on MetaTrader | ✕ | ✕ | ✓ | 1:30 (Retail) 1:400 (Pro) | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, DBots | ✕ | ✕ | ✕ | 1:1000 | ✓ | ✓ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✓ | 1:Unlimited | ✓ | ✕ | |

✓ | ✕ | ✕ | ✕ | 1:1000 | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:1000 | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:500 | ✓ | ✕ |

See how the top crypto brokers compare in every core area following our latest tests:

“AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets.”

Bonus Offer | 20% Welcome Bonus up to $10,000 |

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

Minimum Deposit | $100 |

Minimum Trade | 0.01 Lots |

Leverage | 1:30 (Retail) 1:400 (Pro) |

Account Currencies | USD, EUR, GBP, CAD, AUD |

“Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours.”

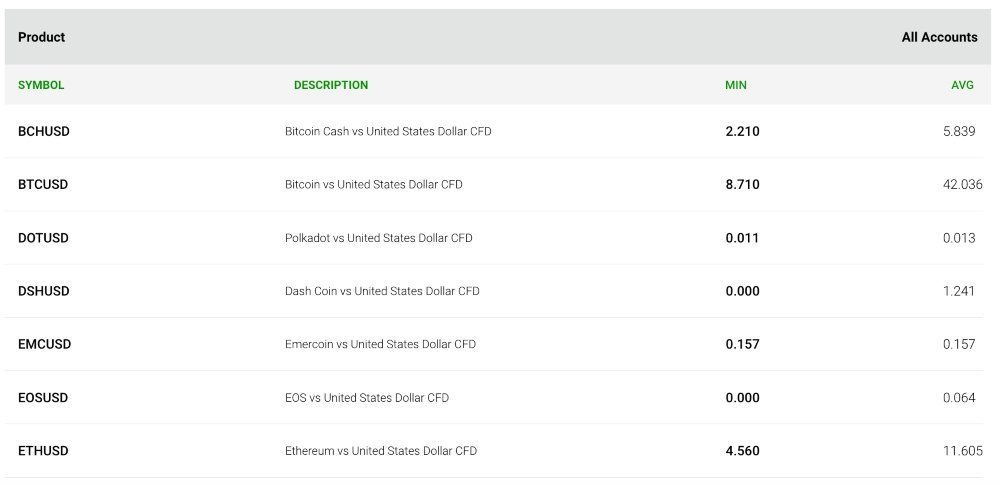

Coins | ADA, ALG, AVA, BAT, BCH, BNB, BTC, DOG, DOT, DSH, EOS, ETC, ETH, FIL, IOT, LNK, LTC, MKR, NEO, OMG, SOL, TRX, UNI, XLM, XMR, XRP, XTZ, ZEC |

Crypto Mining | No |

Auto Market Maker | No |

Crypto Spread | From 0.5 |

Crypto Lending | No |

Crypto Staking | No |

Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

Minimum Deposit | $5 |

Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

Account Currencies | USD, EUR, GBP |

“After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs.”

Coins | BTC, ETH |

Crypto Mining | No |

Auto Market Maker | No |

Crypto Spread | Floating |

Crypto Lending | No |

Crypto Staking | No |

Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

Minimum Deposit | Varies based on the payment system |

Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

“PrimeXBT is perfect for aspiring traders looking for crypto derivatives alongside traditional markets like forex and indices, all tradable on an intuitive, web-based platform. The copy trading solution is also ideal for hands-off traders with 5-star ratings and performance graphs to help you find the right trader.”

Bonus Offer | $100 Deposit Bonus |

Coins | BTC, LTC, ETH, XRP, EOS, ADA, DOT, SOL, UNI, LINK, DOGE, BNB, ICP, SAND, more |

Crypto Mining | No |

Auto Market Maker | No |

Crypto Spread | 0.05% BTC, 0.05% ETH |

Crypto Lending | No |

Crypto Staking | No |

Platforms | Own |

Minimum Deposit | $0 |

Account Currencies | USD, EUR, GBP |

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

Coins | BTC, ETH, LTC, XRP, BCH |

Crypto Mining | No |

Auto Market Maker | No |

Crypto Spread | Variable |

Crypto Lending | No |

Crypto Staking | No |

Platforms | MT4, MT5, TradingCentral |

Minimum Deposit | $5 |

Regulator | ASIC, CySEC, DFSA, IFSC |

Account Currencies | USD, EUR, GBP |

“Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it’s also become a stand-out choice for crypto trading, winning our ‘Best Crypto Broker’ award two years in a row.”

Coins | BTC, ETH, LTC, BCH, XRP, XMR, DSH, EOS, XLM, ADA, TRX, DOGE, BNB, DOT, MATIC, VET, AXS, NEO, SOL, UNI, AAVE, KSM, THETA, CAKE, SUSHI, ATOM, XTZ, SNX, COMP, FLOW, EGLD, PUNDIX, RAY, ZIL, QTUM, BAND, OMG, FIDA, BADGER, NEAR and many more |

Crypto Mining | No |

Auto Market Maker | No |

Crypto Spread | $12 (BTC) |

Crypto Lending | No |

Crypto Staking | No |

Platforms | MT4, MT5, TradingView |

Minimum Deposit | $100 |

Regulator | ASIC, FCA, CySEC, SCB |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

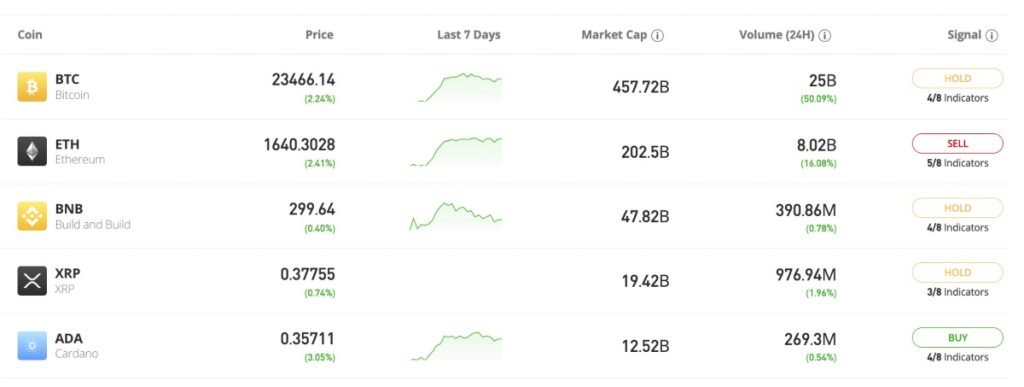

Crypto brokers give you a way to trade cryptos like Bitcoin online. Unlike crypto exchanges, where you buy and sell digital money directly, brokers are usually established businesses that handle other types of assets. They often have several licenses, which could make them a safer way to trade cryptos because exchanges usually have little to no rules. Some crypto brokers might let you buy and sell crypto tokens straight up, but most offer trading through things like CFDs. These derivatives usually let you trade with leverage. This means you can increase your profits (or losses) by a certain amount. Because crypto is unstable, the leverage is usually lower than what you see with other assets. Most crypto brokers we checked out offer 1:2 leverage on cryptos. But, for regular currencies, you can often get up to 1:30 leverage in places like Europe.

Crypto exchanges, such as Binance, are popular for trading tokens because they let you buy and sell just like on a stock exchange. Plus, some exchanges have margin trading and decentralized finance (DeFi) stuff, so you can get your digital stuff working for you. So, why go with crypto brokers? Well, safety is a big deal. From Mt. Gox going under in 2014 to the FTX mess in 2022, these exchanges haven’t always been managed well, and sometimes they do shady stuff or go bankrupt, losing a ton of customers’ money. Brokers do some of the same things as exchanges, but many have regulators watching them, which lowers the risk, we think. Just remember, not every crypto broker is regulated for crypto trading. Online brokers usually don’t put all their eggs in the crypto basket, so they can handle the ups and downs of the crypto market better. EToro, for instance, has stocks and commodities along with cryptos. Lastly, a lot of crypto brokers have things like CFDs or binary options that you might not find on an exchange. You can bet on crypto without actually buying it, which means you don’t have to stress about exchanges getting hacked or keeping keys safe.

First, you’ll want to create an account with a broker that lets you trade crypto. When you sign up, you’ll usually need to give them your contact info, prove who you are, and put down a downpayment (usually between $0 and $500). Most crypto brokers let you trade tokens with regular money, like trading USD for Bitcoin. Once you pick a crypto to trade, you can just place an order through your broker’s platform or app. Whether you win or lose money, and how much, depends on which way the market goes when you end the trade, and any costs involved.

Crypto brokers are a great way to trade digital stuff fast. You can make gains from the market’s ups and downs while dodging some risks from normal crypto exchanges. Picking a crypto broker is up to you. But you can use our list of the best ones to find what fits you.

We see crypto brokers as a step up from exchanges in terms of security since they tend to have better regulatory oversight and a longer track record.

That said, not all crypto brokers are necessarily regulated for their digital currency operations. Also, not all brokerages are equal in terms of service and security.

You should deal with one that is reputable and trusted.

Yes, there are online crypto brokers that offer leverage. Rates are usually capped at around 2x (1:2) your deposit amount, however, some firms offer up to 5x (1:5) leverage on certain digital assets.

It’s worth noting that some regulators, including the UK’s FCA, have imposed blanket restrictions banning leverage for crypto markets.

Our analysis shows that AvaTrade, OANDA, Eightcap, IC Markets and NordFX are all excellent brokers for day trading cryptocurrencies. They offer a good range of digital currencies including Bitcoin, low fees, great charting tools, access to leverage, and are trusted.

Copyright © 2025 Think Forex Brokers