To find the best brokers for day trading, look for low fees, great charts, fast trades, global market access, and margin. Also, make sure they’re trustworthy and don’t require huge minimum deposits. Check out our picks for the top platforms that fit the bill.

After performing hands-on tests of 227 brokers as of August 2025, these are the 6 best platforms for day trading:

74-89% of retails CFD accounts lose money

73.85 % of retails CFD accounts lose money

59.57 % of retails CFD accounts lose money

76 % of retails CFD accounts lose money

70.64 % of retails investor accounts lose money

72.82 % of retails accounts lose money

Here’s a rundown of why these day trading platforms topped our rankings:

See how good these brokers are for day trading on mobile following our app evaluations:

Beginners should choose brokers that allow day trading in a demo account with other features new traders need:

Experienced traders should look for value-add features to enhance the day trading experience:

Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✓ | 1:Unlimited | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✓ | ✕ | ✕ | 1:2000 | ✕ | ✕ | |

Expert Advisors (EAs) on MetaTrader, DBots | ✕ | ✕ | ✕ | 1:1000 | ✓ | ✓ | |

Expert Advisors (EAs) on MetaTrader | ✕ | ✕ | ✓ | 1:30 (Retail) 1:400 (Pro) | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✓ | ✕ | ✕ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:1000 | ✓ | ✕ |

See how the top brokers for day trading scored in every key area in our hands-on tests:

“After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs.”

Demo Account | Yes |

Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

Minimum Deposit | Varies based on the payment system |

Minimum Trade | 0.01 Lots |

Leverage | 1:Unlimited |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

“RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists.”

Bonus Offer | $30 No Deposit Bonus |

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

Regulator | IFSC |

Platforms | R StocksTrader, MT4, MT5, TradingView |

Minimum Deposit | $10 |

Minimum Trade | 0.01 Lots |

Leverage | 1:2000 |

Account Currencies | USD, EUR |

“Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours.”

Demo Account | Yes |

Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

Minimum Deposit | $5 |

Minimum Trade | 0.01 Lots |

Leverage | 1:1000 |

Account Currencies | USD, EUR, GBP |

“AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets.”

Bonus Offer | 20% Welcome Bonus up to $10,000 |

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

Minimum Deposit | $100 |

Minimum Trade | 0.01 Lots |

Leverage | 1:30 (Retail) 1:400 (Pro) |

Account Currencies | USD, EUR, GBP, CAD, AUD |

“IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders.”

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

Regulator | ASIC, CySEC, FSA, CMA |

Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

Minimum Deposit | $200 |

Minimum Trade | 0.01 Lots |

Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

Regulator | ASIC, CySEC, DFSA, IFSC |

Platforms | MT4, MT5, TradingCentral |

Minimum Deposit | $5 |

Minimum Trade | 0.01 Lots |

Leverage | 1:1000 |

Account Currencies | USD, EUR, GBP, JPY |

Below, we explain the key factors our team, and you, should consider when choosing a broker for day trading.

Picking a day trading broker you can trust is super important. It helps keep you safe from scams and unfair stuff, and it protects your money. We only suggest platforms that we think are good. We always check them out by looking at their licenses, how long they’ve been around, and what people say about them. You can check out who keeps our best brokers in line down below.

Exness | RoboForex | Deriv | AvaTrade | XM | |

Trust Rating | 4.08/5 | 3.05/5 | 3.41/5 | 4.87/5 | 3.93/5 |

Regulators | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | IFSC | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | ASIC, CySEC, DFSA, IFSC |

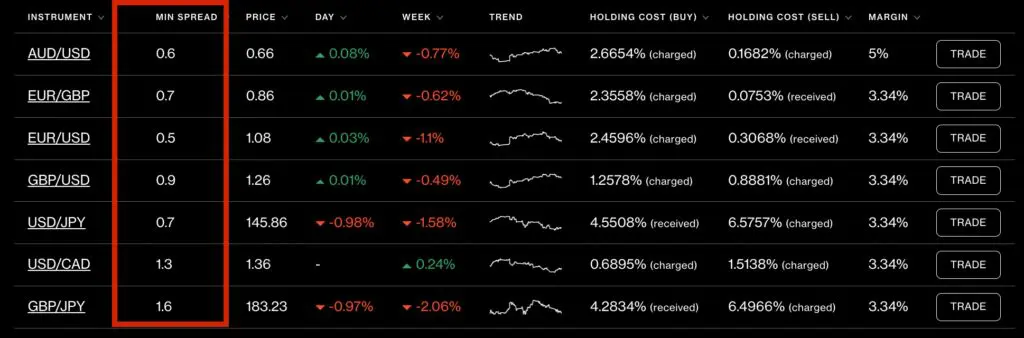

When you’re day trading, picking a broker with low fees is super important. All those trades can really add up, cutting into your profits. We checked out different platforms and noted down their trading and non-trading fees year by year. That way, we can suggest ones that won’t eat away at your money with high costs.

You can compare the typical fees you will incur at our best brokers below.

Exness | RoboForex | Deriv | AvaTrade | IC Markets | |

Fee Rating | 4.08/5 | 3.5/5 | 2.96/5 | 3.87/5 | 4.58/5 |

EUR/USD Spread | 0.0 | 0.1 | 1.4 | 0.9 | 0.02 |

Oil Spread | 0.0 | 1.7 | 0.02 | 0.02 | 0.03 |

Stock Fee | 0.5 (Apple Inc.) | 0.01 | 0.59 (Apple) | 0.13 | 0.02 |

Inactivity Fee | $0 | $0 | $25 | $50 | $0 |

If you’re a day trader, picking a broker with a great charting platform is a must because most of you guys use technical analysis to spot chances to trade during the day. Most brokers give you a bunch of platforms to pick from. Some will work just fine for most day traders since they’re easy to use. Others have better charting and analysis tools for those who’ve been trading for a while.

You can compare the platforms and apps available at our best brokers below.

Exness | RoboForex | Deriv | AvaTrade | XM | |

Platform Rating | 4.08/5 | 3.96/5 | 4.54/5 | 3.87/5 | 4.83/5 |

Charting Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | R StocksTrader, MT4, MT5, TradingView | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, TradingCentral |

Mobile App | iOS & Android | iOS & Android, R StocksTrader | iOS & Android | iOS & Android | iOS, Android & Windows |

Automated Trading | Expert Advisors (EAs) on MetaTrader | Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | Expert Advisors (EAs) on MetaTrader, DBots | Expert Advisors (EAs) on MetaTrader | Expert Advisors (EAs) on MetaTrader |

Picking a broker that lets you trade the markets you care about is super important since not all of them offer the same stuff. The brokers we suggest here let you get into popular markets all over the world, like stocks, currencies, and commodities. We actually check this out by logging into their platforms and noting down what you can trade. We also look to see if they have trading options that are good for day traders, such as CFDs. These let you bet on price changes without having to actually own the thing you’re trading. Check out our top brokers below to see which markets they offer.

Exness | RoboForex | Deriv | AvaTrade | XM | |

Markets Rating | 3.48/5 | 3.96/5 | 4.96/5 | 4.47/5 | 4.53/5 |

Day Trading Markets | CFDs on Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

Picking a broker that’s quick is super important for day trading since the market changes fast. If your orders are slow, you might miss out on trades or not get good prices. How well a broker executes trades also matters a lot. It’s about speed, price, and if your order actually goes through. This helps you see if you’re getting the best deal.

You can compare the platforms and apps available at our best brokers below.

Picking a broker that lets you trade with margin is key for day trading. It can boost your gains since you can control bigger positions with less money. But heads up – it also means bigger losses can happen fast, so beginners should be extra cautious. Good risk control is a must, and you should know your broker’s margin rules. These rules say how much cash you need to have.

Exness | RoboForex | Deriv | AvaTrade | XM | |

Margin Trading | Yes | Yes | Yes | Yes | Yes |

Day Trading Markets | 1:Unlimited | 1:2000 | 1:1000 | 1:30 (Retail) 1:400 (Pro) | 1:1000 |

If you’re just starting out in day trading and don’t have a ton of cash, picking a broker that doesn’t require a huge initial deposit is key. The day trading platforms we suggest are pretty accessible. We looked at how much you need to get started and if the accounts are a fit for all levels of traders—from newbies to more experienced ones. Take a look below to compare the minimum amounts needed to open an account with our top broker picks.

Exness | RoboForex | Deriv | AvaTrade | XM | |

Minimum Deposit | Varies based on the payment system | $10 | $5 | $100 | $5 |

Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

To find the best brokers for day trading we considered quantitative data and qualitative insights gathered during our comprehensive reviews, focusing on seven criteria:

Day trading is a strategy where individuals buy and sell financial instruments within the same trading day, seeking to profit from short-term price movements.

Day trading offers the potential for fast profits as traders take advantage of short-term price fluctuations. Additionally, day traders can operate with reduced overnight risk since they often close positions before the market closes.

Day trading entails several risks. Firstly, there is the risk of financial loss if you make losing trades because of market volatility and emotional decision-making.

There is also the risk of signing up with fraudulent brokers operating scams, making it important to choose a trusted and regulated day trading broker.

Yes, you normally need a broker to day trade. Your broker will provide a platform and the infrastructure to execute intraday trades in financial markets.

We have ranked the best brokers for day traders. In conducting our comparison, we considered multiple factors, from regulatory credentials and fees to the quality of the platform for intraday trading, the speed of order executions, and the minimum deposit to open an account.

To open a day trading account you will need to sign up with a broker. You usually need to provide basic contact details and information about your trading experience and source of funds, a process which often takes around 15 minutes.

Most regulated day trading brokers also need to verify your identity and address before you can unlock all trading features.

Account minimums vary between day trading platforms. Some require thousands of dollars in return for sophisticated features that cater to advanced traders. Alternatively, many brokers have an accessible minimum deposit of less than $500. Some brokerages even have no minimum deposit.

Copyright © 2025 Think Forex Brokers