We checked out tons of platforms to find the top forex brokers. Check out these forex trading platforms, they’re great because of:

We’ve evaluated 227 forex providers as of August 2025 and these are our 6 best brokers for day trading forex:

72.82 % of retails accounts lose money

73.85 % of retails CFD accounts lose money

Trading leveraged product is risky

70.64 % of retails investor accounts lose money

Here’s a snapshot of why these forex brokers beat out the competition in our latest tests:

Find the right provider for you with our comparison of the elements most important to active FX traders:

Broker | Number of Currency Pairs | EUR/USD Spread | Currency Indices | Forex App Rating | Minimum Deposit | Regulators |

55+ | 0.8 | USD | 4.7 / 5 | $5 | ASIC, CySEC, DFSA, IFSC | |

30+ | 0.1 | - | 3.3 / 5 | $10 | IFSC | |

40+ | 1.4 | - | 4.8 / 5 | $5 | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA | |

100+ | 0.0 | USD | 4.4 / 5 | Varies based on the payment system | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | |

55+ | 0.0 | USD | 4 / 5 | $50 | FCA, ASIC, FSCA, VFSC | |

75 | 0.02 | - | 4.8 / 5 | $200 | ASIC, CySEC, FSA, CMA |

New traders should pick a broker that allows forex trading with virtual money, alongside other features geared towards beginners:

Seasoned traders should look for powerful tools to elevate the forex trading experience:

Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:1000 | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✓ | ✕ | ✕ | 1:2000 | ✕ | ✕ | |

Expert Advisors (EAs) on MetaTrader, DBots | ✕ | ✕ | ✕ | 1:1000 | ✓ | ✓ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✓ | 1:Unlimited | ✓ | ✕ | |

Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:2000 | ✕ | ✕ | |

Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✓ | ✕ | ✕ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✓ | ✕ |

See how our top forex trading brokers rate in key areas after our in-depth tests of their FX trading capabilities:

The cost of frequently trading currencies adds up over time, so here’s how our leading forex brokerages measure up on pricing:

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

GBPUSD Spread | 0.8 |

EURUSD Spread | 0.8 |

EURGBP Spread | 1.5 |

Total Assets | 55+ |

Leverage | 1:1000 |

Platforms | MT4, MT5, TradingCentral |

Account Currencies | USD, EUR, GBP, JPY |

“RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists.”

Bonus Offer | $30 No Deposit Bonus |

GBPUSD Spread | 0.4 |

EURUSD Spread | 0.1 |

EURGBP Spread | 0.4 |

Total Assets | 30+ |

Leverage | 1:2000 |

Platforms | R StocksTrader, MT4, MT5, TradingView |

Account Currencies | USD, EUR |

“Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours.”

GBPUSD Spread | 1.4 |

EURUSD Spread | 1.4 |

EURGBP Spread | 1.0 |

Total Assets | 40+ |

Leverage | 1:1000 |

Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

Account Currencies | USD, EUR, GBP |

“After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs.”

GBPUSD Spread | 0.0 |

EURUSD Spread | 0.0 |

EURGBP Spread | 0.0 |

Total Assets | 100+ |

Leverage | 1:Unlimited |

Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

“Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly.”

Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

GBPUSD Spread | 0.5 |

EURUSD Spread | 0.0 |

EURGBP Spread | 0.5 |

Total Assets | 55+ |

Leverage | 1:2000 |

Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

“IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders.”

GBPUSD Spread | 0.23 |

EURUSD Spread | 0.02 |

EURGBP Spread | 0.27 |

Total Assets | 75 |

Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

To find the top forex brokers for day trading, we looked at who does well in some key areas, which I’ll explain below.

We chose forex platforms with a wide range of currency pairs, providing diverse trading opportunities while enabling investors to spread risk and use various short-term strategies.

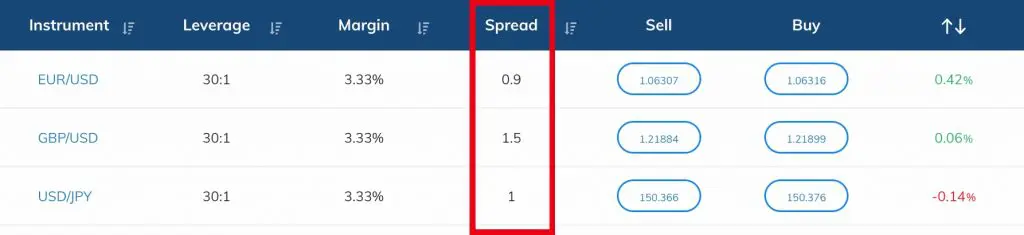

We picked low-cost forex platforms to help you get the most from your money. Even small fee differences can add up if you trade a lot. We checked the lowest spreads on popular pairs like EUR/USD, GBP/USD, and EUR/GBP, and we looked at the average spreads too. To do this, we kept track of spreads during peak trading times – when the US/London markets overlapped, and again when Sydney/Tokyo markets overlapped. Then, we compared those to what’s typical in the industry.

Next, we looked at all the commissions and fees that aren’t related to trading, like charges for deposits, withdrawals, and being inactive. This gave us a clear idea of what costs to expect when you’re day trading currencies. Our best forex brokers give great prices, usually with spreads of less than 1 pip on the EUR/USD, and they often have no or small deposit/withdrawal charges and inactivity fees. Having said that, IC Markets is really good. It usually has the lowest cost for forex trading because they always have really low spreads.

We picked forex brokers with great platforms, looking for easy-to-use interfaces and charting tools since many day traders use technical analysis to find chances in the forex market. Since many people are trading forex on their phones, according to Astute Analytica, it’s important to be able to trade while on the go. After trying a lot of forex apps, we realized that not all mobile apps are as good as the desktop versions. Charts might not work well on phones, or you might not be able to use the app horizontally, which makes for a not-so-great experience.

Forex brokerages are increasingly developing their own software, but the two most popular third-party platforms, supported by the vast majority of online brokers, are still:

Our best forex day trading brokers all deliver in the tooling department, with most offering the MetaTrader suite, as well as further proprietary and third-party platforms in some instances, with FOREX.com leading the way with its terrific web platform that we loved using during testing.

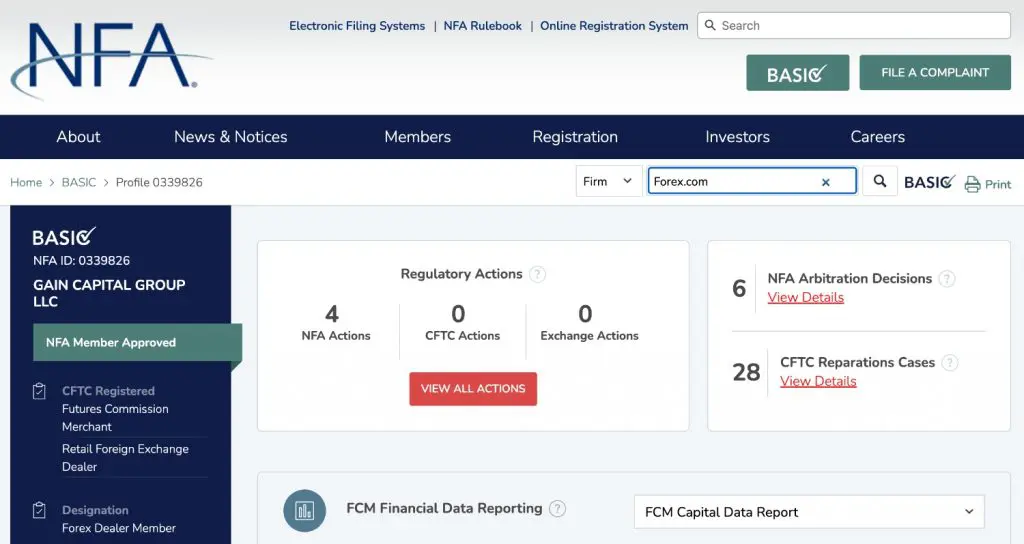

We picked brokers approved by solid regulators to keep forex traders safe from scams. This is key because the US Commodity Futures Trading Commission (CFTC) says they’ve “seen a big jump in forex trading scams lately.” Choosing a well-regulated broker also means your account’s got safety nets. This includes protection from going into a negative balance so you can’t lose more than you have, limits on how much you can borrow to avoid huge losses, and rules about forex bonuses to stop people from trading too much.

Our best forex platforms are approved by a bunch of high-ranking agencies, according to DayTrading.com’s rating system. They’ve got good trust scores because of their licenses, how they’re seen in the business, and what our traders have said after trying them out. But, IG is the best choice because it has a lot of licenses and a safe place to trade forex. Plus, it has special tools to control risk that you cannot find anywhere else.

We picked forex platforms that execute orders quickly and reliably, ideally in under 100 milliseconds, without any requotes. This is important for short-term trading because the foreign exchange market moves so fast. The forex market changes a lot, even faster than stocks. Day traders have to take advantage of these quick changes to make cash. Forex brokers that execute orders fast can help make sure trades happen near the points you want, while also reducing slippage.

Day traders often use leverage to increase how much they can buy. This means small changes in currency value can lead to big wins or losses. Good execution can help make the most of the returns and also manage the risks. Most of the best forex brokers do well in terms of order quality. For example, Pepperstone is super fast, with speeds of around 30ms.

Day trading forex involves speculating on the fluctuations in exchange rates between currencies, such as the EUR/USD or GBP/USD.

Day traders can make a profit by correctly predicting whether the value of one currency will rise or fall relative to another within the same trading day.

To start day trading forex you will need to open an account with an online broker. You will also need starting capital to fund your account and execute day trades.

Our analysis shows that many of the best forex day trading platforms accept new clients with a minimum deposit up to $250. However, some brokers stand out with no minimum investment, catering to budget traders – the highest-rated is Pepperstone.

Importantly, you will also need a strategy to help you decide which currency pairs to speculate on and when to exit and enter the market. A sensible approach to risk management is also required to ensure you do not lose more than you can afford.

MetaTrader 4 (MT4) is the most popular forex trading platform.

The third-party trading solution, designed for trading currencies, is offered by the majority of online brokers as a desktop client, web trader and mobile app, having been downloaded from the App Store and Google Play more than 10 million times.

Copyright © 2025 Think Forex Brokers