Since it came out in 2005, MetaTrader 4 (MT4) has become super popular with traders who are always in the market. People love it because it has great charts, you can change it how you like, it lets you do automated trading with Expert Advisors (EAs), and lots of brokers support it. DayTrading.com has a list of what they think are the best MT4 brokers. Their team of experts, who are traders themselves and have spent tons of time making their own MetaTrader algorithms, has checked out each broker.

74-89% of retails CFD accounts lose money

74-89 % of retails CFD accounts lose money

70.64 % of retails investor accounts lose money

75.5 % of retails CFD accounts lose money

Here is why we think these are the top MT4 brokers:

Find the right MT4 broker for you with our comparison of key features:

Broker | MT4 Integration | Instruments | Regulators |

✓ | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | |

✓ | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | IFSC | |

✓ | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | |

✓ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA, CMA | |

✓ | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | ASIC, CySEC, DFSA, IFSC | |

✓ | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

How reliable are the top MT4 brokers and do they have features that help protect your funds?

Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

3.8 | ✕ | ✓ | ✓ | |

3 | ✕ | ✓ | ✓ | |

4.8 | ✕ | ✓ | ✓ | |

4.6 | ✕ | ✓ | ✓ | |

4.1 | ✕ | ✓ | ✓ | |

4.6 | ✕ | ✓ | ✓ |

Are these brokers good for trading on MT4 from mobile?

Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

iOS & Android | 4.4 | 4.3 | ✕ | |

iOS & Android, R StocksTrader | 4.7 | 4.4 | ✕ | |

iOS & Android | 4.3 | 4 | ✕ | |

iOS & Android | 3.1 | 4.2 | ✕ | |

iOS, Android & Windows | 4.7 | 3.9 | ✕ | |

iOS & Android | 4.4 | 4.1 | ✕ |

Traders new to MT4 should use brokers that allow trading with virtual money (a demo account) alongside other features that beginners will benefit from.

Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

✓ | Varies based on the payment system | 0.01 Lots | 1.5 | 3.8 | |

✓ | $10 | 0.01 Lots | 3.8 | 4.3 | |

✓ | $100 | 0.01 Lots | 4.5 | 4.3 | |

✓ | $200 | 0.01 Lots | 3.5 | 4.5 | |

✓ | $5 | 0.01 Lots | 4.8 | 4.9 | |

✓ | $0 | 0.01 Lots | 4 | 4.6 |

Are these brokers with MT4 integration suitable for advanced traders?

Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✓ | 1:Unlimited | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✓ | ✕ | ✕ | 1:2000 | ✕ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✕ | ✕ | ✓ | 1:30 (Retail) 1:400 (Pro) | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✓ | ✕ | ✕ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✕ | 1:1000 | ✓ | ✕ | |

Expert Advisors (EAs) on MetaTrader | ✓ | ✕ | ✓ | 1:30 (Retail), 1:500 (Pro) | ✓ | ✕ |

Discover how the top MT4 brokers stack up in key areas from our hands-on tests.

Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

3.8 | 3.8 | 3.5 | 4.4 | 3.8 | 4.3 | 4.3 | 1.5 | 3.8 | |

3 | 4.1 | 4 | 4.6 | 3.5 | 4 | 3.8 | 3.8 | 4.3 | |

4.8 | 4.3 | 4.5 | 4.2 | 3.8 | 4.3 | 4.3 | 4.5 | 4.3 | |

4.6 | 4 | 3.5 | 3.7 | 4.6 | 4 | 4 | 3.5 | 4.5 | |

4.1 | 4.8 | 4.5 | 4.3 | 4 | 4.5 | 4.3 | 4.8 | 4.9 | |

4.6 | 4.4 | 3.8 | 4.3 | 4.5 | 4 | 4.3 | 4 | 4.6 |

The cost of trading on MT4 with a broker will add up over time.

Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

3.8 | ✕ | $0 | |

3.5 | ✕ | $0 | |

3.8 | ✓ | $50 | |

4.6 | ✕ | $0 | |

4 | ✕ | $5 | |

4.5 | ✓ | $0 |

“After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs.“

Demo Account | Yes |

Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

Minimum Deposit | Varies based on the payment system |

Minimum Trade | 0.01 Lots |

Leverage | 1:Unlimited |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

“RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists.”

Bonus Offer | $30 No Deposit Bonus |

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

Regulator | IFSC |

Platforms | R StocksTrader, MT4, MT5, TradingView |

Minimum Deposit | $10 |

Minimum Trade | 0.01 Lots |

Leverage | 1:2000 |

Account Currencies | USD, EUR |

“AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets.”

Bonus Offer | 20% Welcome Bonus up to $10,000 |

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

Minimum Deposit | $100 |

Minimum Trade | 0.01 Lots |

Leverage | 1:30 (Retail) 1:400 (Pro) |

Account Currencies | USD, EUR, GBP, CAD, AUD |

“IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders.”

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

Regulator | ASIC, CySEC, FSA, CMA |

Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

Minimum Deposit | $200 |

Minimum Trade | 0.01 Lots |

Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

Demo Account | Yes |

Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

Regulator | ASIC, CySEC, DFSA, IFSC |

Platforms | MT4, MT5, TradingCentral |

Minimum Deposit | $5 |

Minimum Trade | 0.01 Lots |

Leverage | 1:1000 |

Account Currencies | USD, EUR, GBP, JPY |

“Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support.”

Demo Account | Yes |

Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

Minimum Deposit | $0 |

Minimum Trade | 0.01 Lots |

Leverage | 1:30 (Retail), 1:500 (Pro) |

Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

To compile a list of the best brokers that support MT4, we:

There are six key questions to ask yourself when choosing a broker with access to MetaTrader 4:

Does the broker support MT4 on your preferred device?

Almost every brokerage we’ve assessed supports the downloadable desktop client, web-accessible terminal, or iOS and Android-friendly mobile app. However, consider your needs:

Does the broker support your desired instruments on MT4?

While all MT4 brokers offer forex trading, some increasingly provide additional asset classes like stocks, indices, commodities, and crypto.

Check available instruments before funding an account, as some brokers (eg AvaTrade) may not offer specific products like options trading on MT4.

Does the broker offer low trading fees?

Look for brokers with tight spreads and low or zero commissions, especially if you’re a day trader dealing in high volumes. However, be aware that some brokers may offer wider spreads on MT4 than on their proprietary platforms.

ECN MT4 brokers like Pepperstone are great for low fees, with spreads starting at 0.0 and 25%+ rebate programs for active traders.

Does the broker provide an MT4 demo account?

Most brokers offer MT4 demo accounts, letting you test strategies risk-free. These typically last 14-30 days and come with $10,000-$100,000 in virtual funds.

If you need ongoing access to MT4 demo mode, brokers like IC Markets offer unlimited paper trading as long as you’re active.

Is the broker trustworthy?

Not all MT4 brokers are regulated by reputable authorities, which increases the risk of you falling victim to trading scams and can limit access to safeguards like negative balance protection.

Does the broker offer unique MT4 add-ons?

Some brokers provide a superior MT4 trading experience with extra features to inform trading decisions.

I’ve traded on MT4 for years. My take? It’s great for any trader. It’s both strong and simple, which is why it’s still around. It includes advanced charts, analysis, and automated trading. Basically, it has what you need to win in today’s fast markets. I’ll use my experience with MT4 to show you its main stuff, how to set it up how you like it, and give some tips to get you going.

Downloading And Installing

Getting MT4 up and running is pretty straightforward:

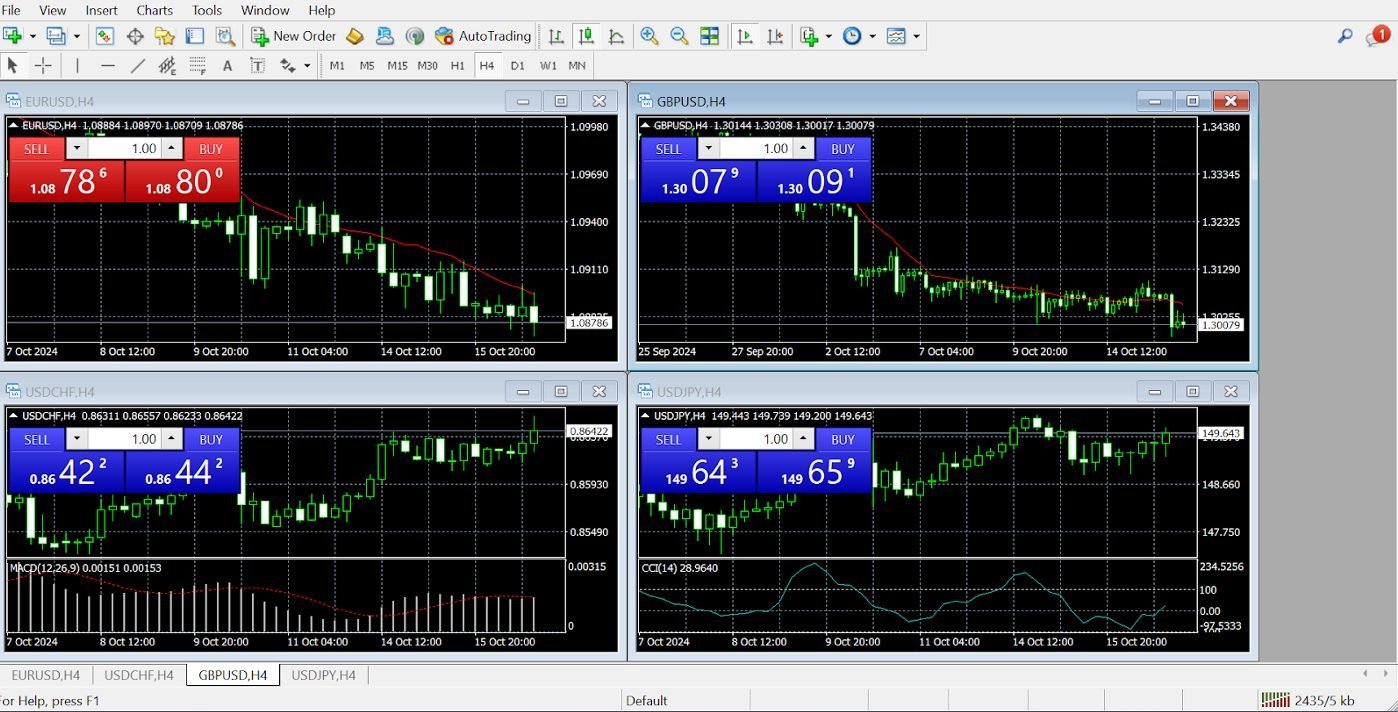

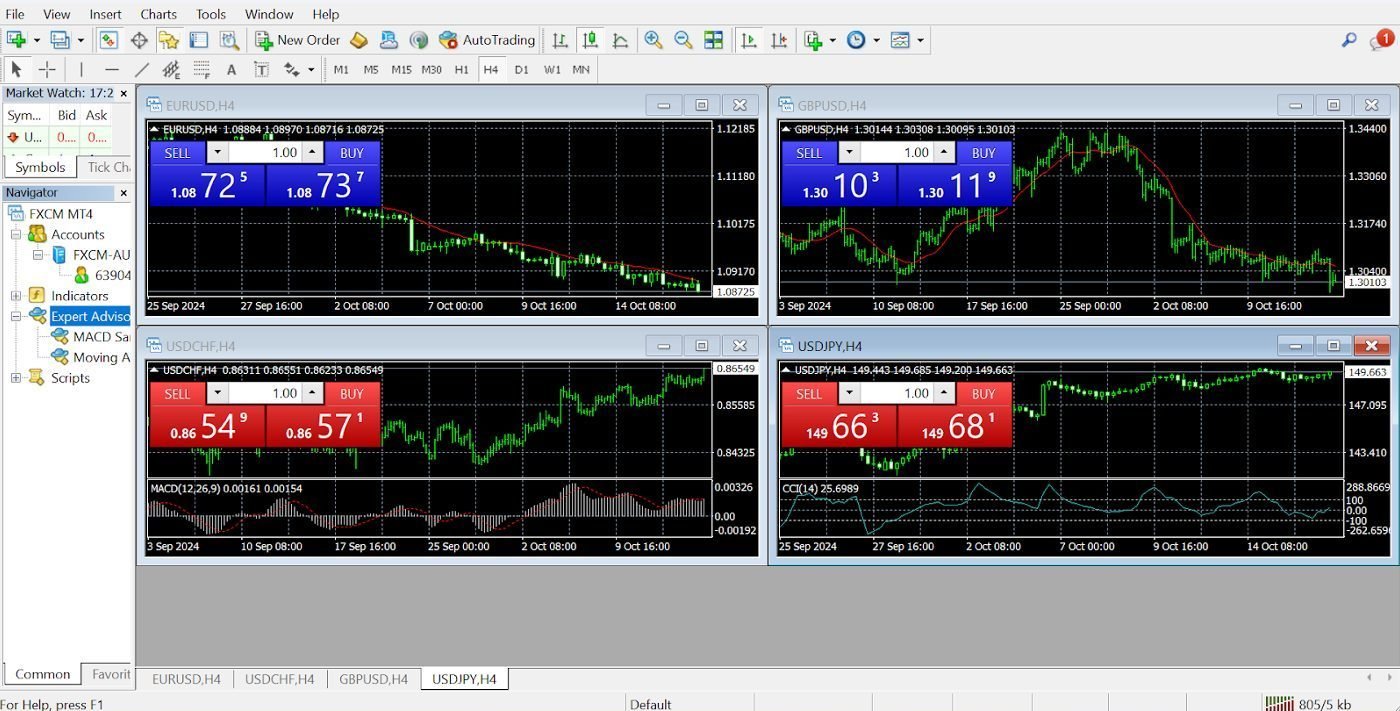

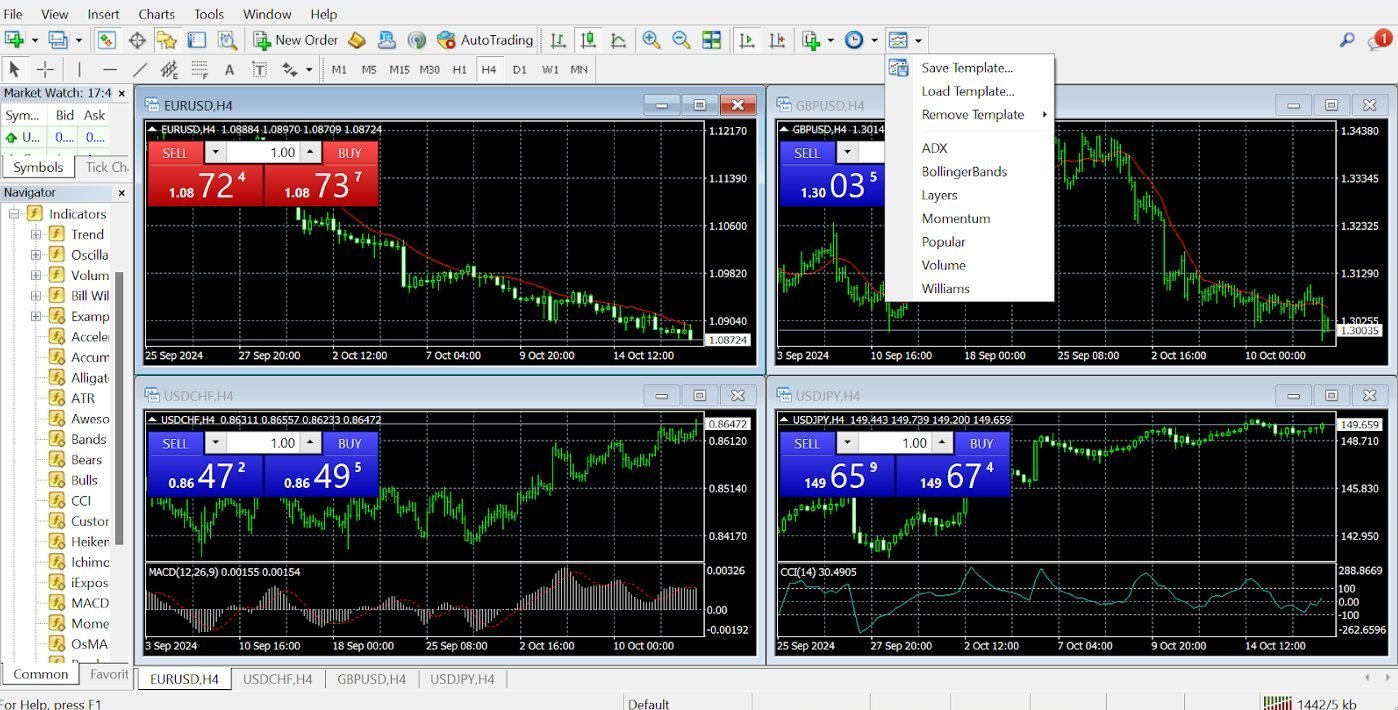

You’ll then be presented with your platform in default form, which will look something like the one below. The standard settings can vary slightly depending on the broker you use to open your MT4 account.

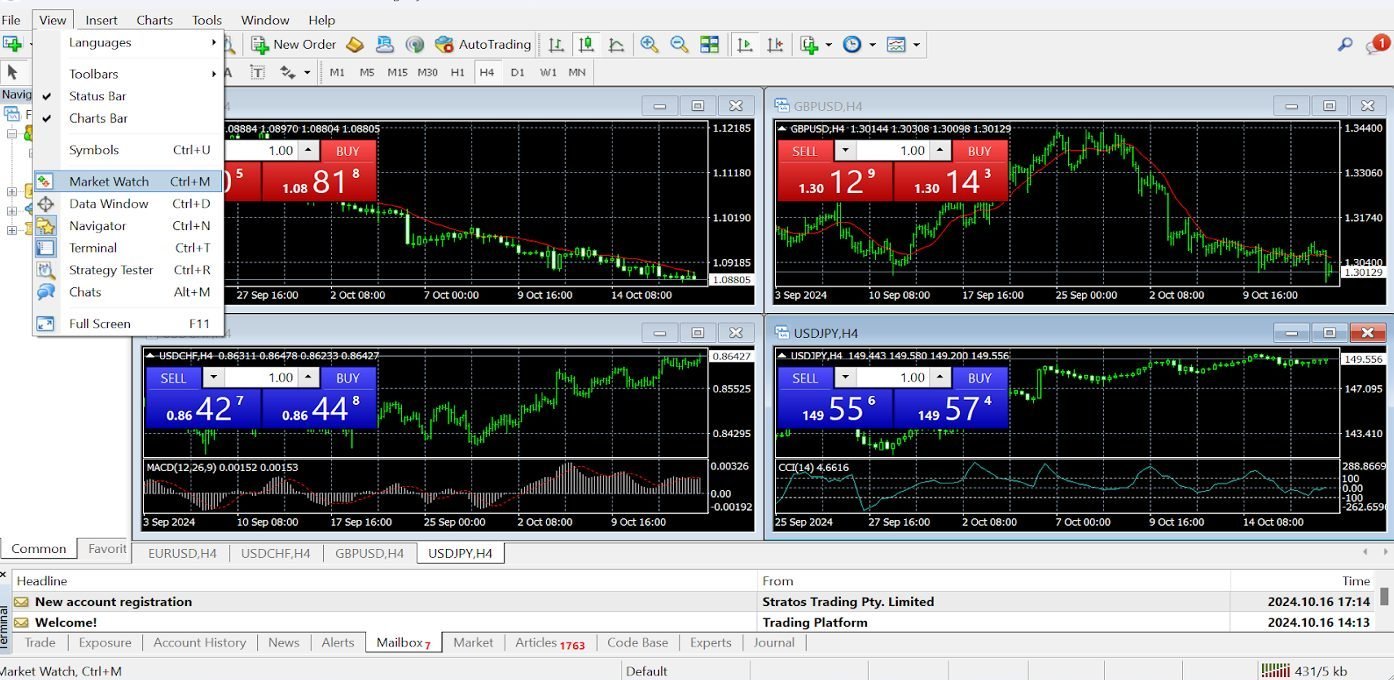

Navigating The Platform

Okay, so when you get your account and log into MT4, head straight to the Terminal down below. It’s where you’ll get all your important stuff like emails, messages from your broker, cool articles, news, strategy ideas, and a record of all your trades.

Get familiar with the icons at the top of the platform navigation. They serve as shortcuts to many features and options.

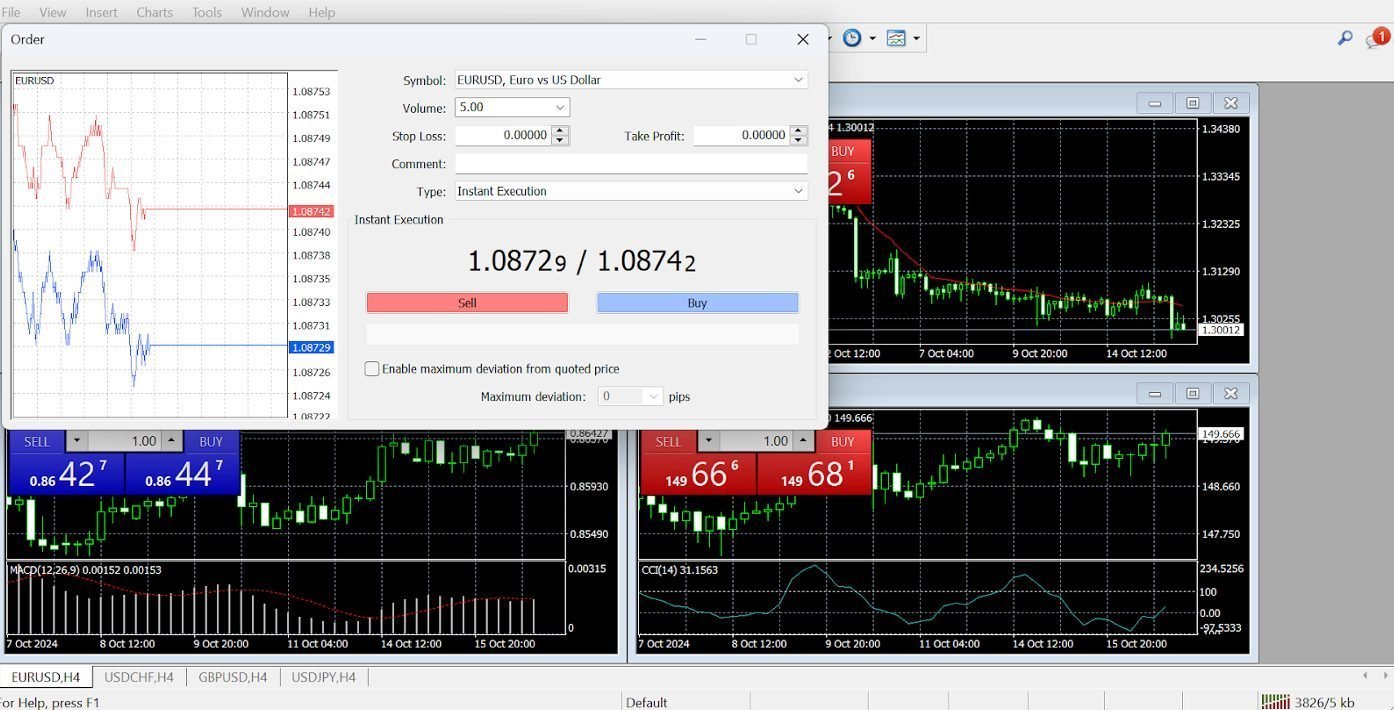

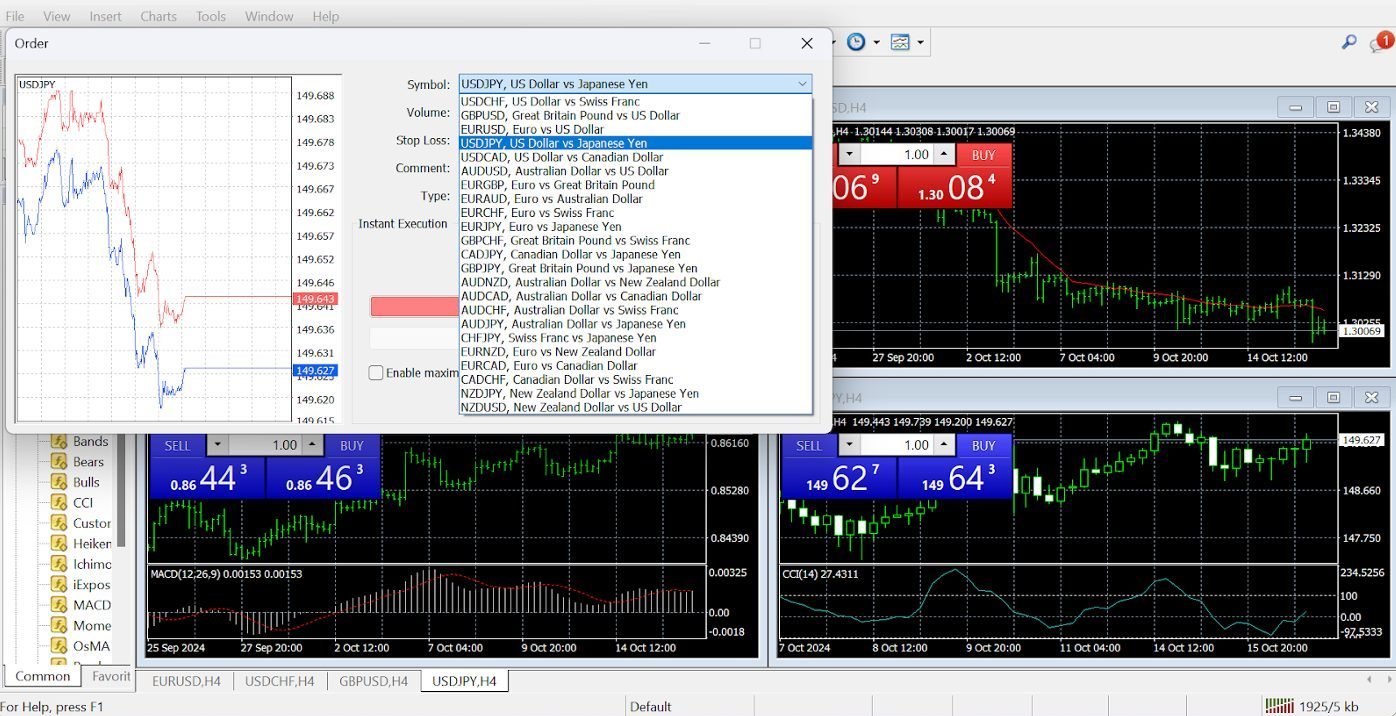

Placing Your First Trade

Ready to make a day trade? Here’s how you do it:

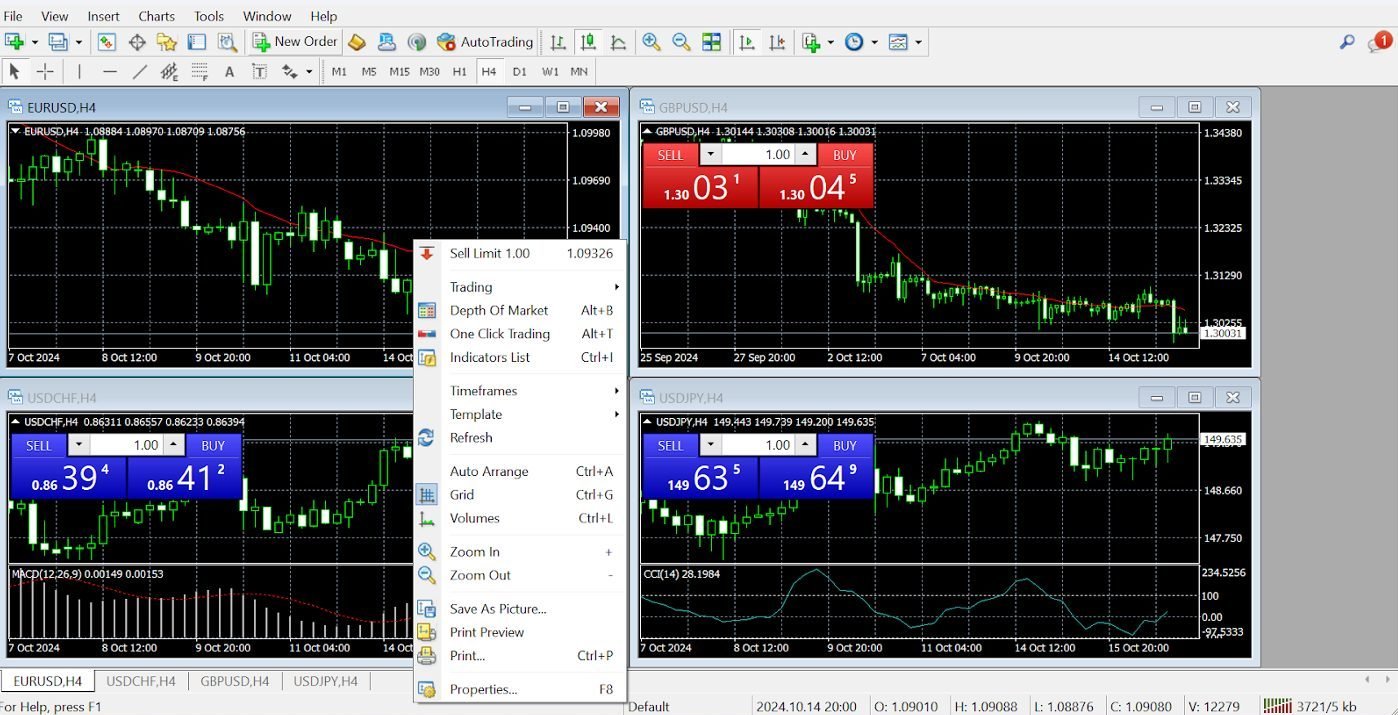

Customizing The Platform

Once you familiarize yourself with the basics, you can dive deeper into customization. Set up hotkeys, adjust chart settings, or add indicators that match your trading style.

MT4 gives you the freedom to make the platform truly yours.

Market Watch And Charting

Okay, so when you start up MT4, look to the left and you’ll see the Market Watch window. That’s where all the current prices are for stuff like forex, commodities, and CFDs. But it’s just the beginning for all the customization.

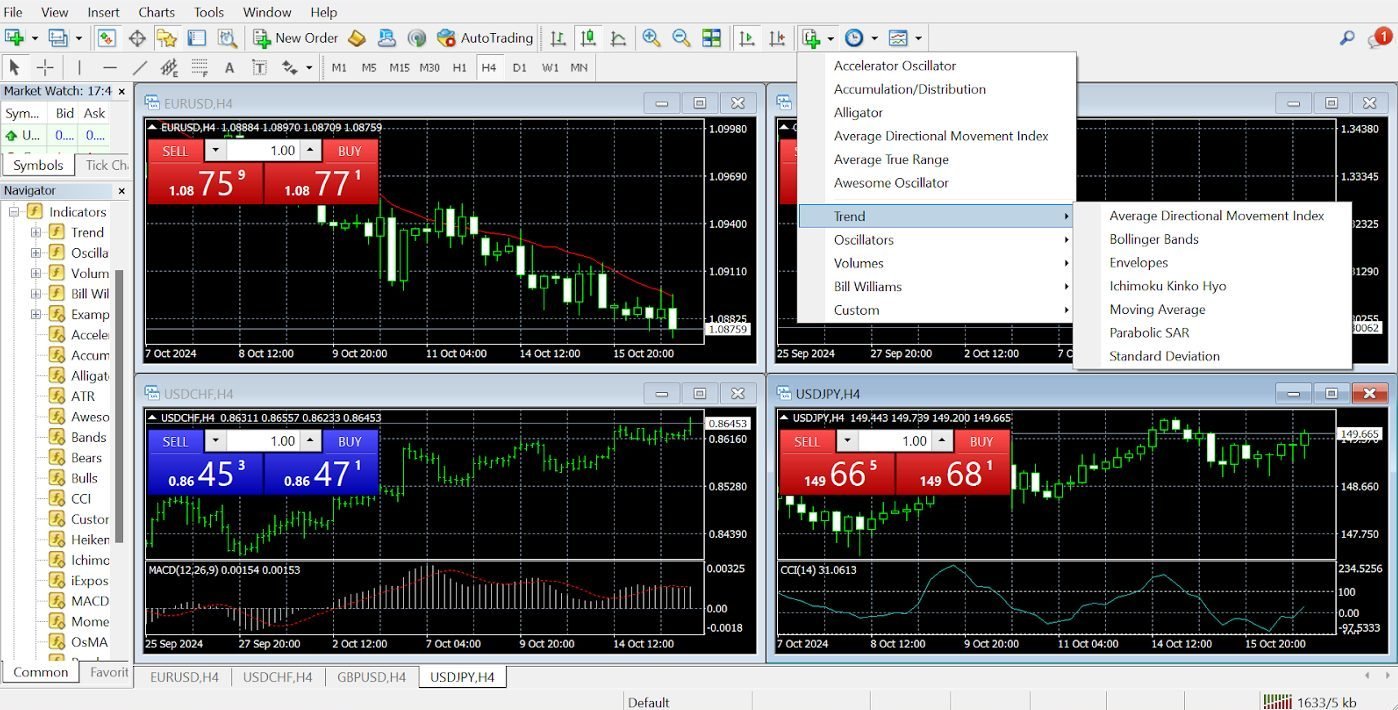

Technical Indicators And Analysis Tools

MT4 has 30 indicators ready to go, things like Moving Averages, RSI, MACD, and Bollinger Bands. If you’re into the technical stuff, you can add more indicators. There are tons of free ones out there, or if you know MQL4, you can even make your own. These tools are useful for reading the market and picking your trades. Like, using the RSI and a Moving Average together can help you catch possible reversals or be sure about trends.

Automated Trading With Expert Advisors (EAs)

One of MT4’s standout features is automated trading using Expert Advisors (EAs). These are essentially bots that can execute trades based on your strategy without needing you to monitor the market 24/7.

You can either write your own EAs, download free ones, or purchase more advanced options from the MT4 marketplace. This is a huge benefit for traders who want to diversify their strategies or run multiple systems simultaneously.

Order Types And Execution

MT4 offers different order types, making it flexible for all kinds of traders. Whether you want to jump into a trade right now or set up an order for later, you have options:

Click the new order icon at the top of the navigation to place an order. You’ll then be able to select from a list of all the currency pairs your broker offers.

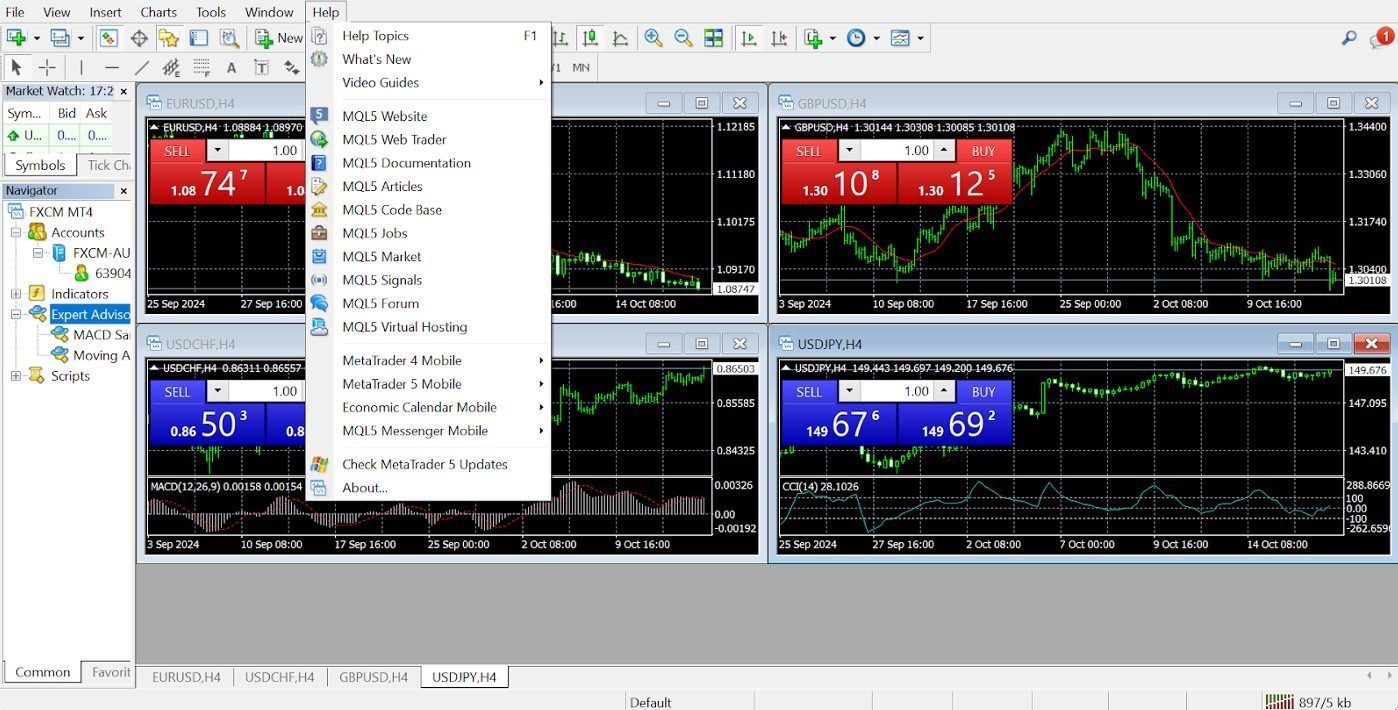

Trading Signals And Copy Trading

MT4 also comes with a Trading Signals thing that lets you copy what experienced traders do. It’s great if you’re a beginner or just don’t have much time. To find it, just click the help button and look for the MQL5 topics, where you will see Market and signals.

Workspace Layouts

MT4 allows you to create and save different workspace layouts. You can set up multiple chart layouts for various strategies and easily switch between them.

If you want the four most traded currency pairs horizontally on your chart, you can save your layouts; simply click file and click profiles. Or click the chart icon at the end of the top nav bar and choose save template.

Custom Timeframes

While MT4 has nine default timeframes, you can add custom ones if you need even more precision. There are ways to tweak the settings or use custom scripts to achieve this.

Chart Themes And Templates

MT4’s charts are fully customizable. You can change colours and themes and even save templates for future use.

For beginners or those primarily interested in forex trading, MetaTrader 4 is the obvious choice. If you’re an advanced trader wanting additional, sophisticated tools, you may prefer MetaTrader 5 (MT5).

Here’s a side-by-side comparison of MT4 and MT5 so you can see where they differ:

Order Types | Technical Indicators | Chart Types | Chart Timeframes | Automated Trading | Economic Calendar | Mobile Compatible | Web Terminal | Desktop Download | Demo Mode | |

MT4 | 4 | 30 | 3 | 9 | MQL4 | N | Y | Y | Y | Y |

MT5 | 5 | 38 | 3 | 21 | MQL5 | Y | Y | Y | Y | Y |

MetaTrader 4 is still popular since it’s strong, flexible, and easy to use. Whether you’re just starting out or have been trading for years, MT4 has cool charting tools, tech indicators, and auto-trading through Expert Advisors (EAs) and copy trading, so it works for all kinds of plans. One reason MT4 is still great is that it’s pretty easy to get into. It has a lot of stuff without being too confusing. The simple design means traders can start trading right away. Also, you can change things up as you get better, so MT4 can keep up with you as your plans change. Plus, there’s a big group of people who keep making new indicators, scripts, and plans, so the platform stays useful over time. So, even though MetaTrader 5 is newer and more advanced, and there are other options like cTrader and TradingView, MT4 is still a top pick for traders because it has good tools but isn’t too hard to use. To pick the right place to trade, check out our list of the best MT4 brokers for day trading.

MetaTrader 4 is not a broker. It is an electronic trading platform licensed to online brokers. The brokerages then offer the platform to their traders.

MetaTrader 4 facilitates access to financial markets through its online trading platform. The platform is split between a client and a server module. The server component is licensed to MT4 brokers while the client portal is used by the broker’s clients.

MetaTrader 4 is free to download and use. However, you’ll pay the usual fees when you place trades, such as spreads, commissions and overnight fees (you can avoid these if you day trade).

We’ve observed some brokers offering wider spreads on MT4 than on their proprietary platforms, so investigate the cost structure before signing up.

MetaTrader 4 is a relatively secure platform that uses 128-bit SSL encryption, two-factor authentication (2FA) and data segregation. However, online trading itself is risky.

Copyright © 2025 Think Forex Brokers