Crypto Trading Guide

- Written By thinkforexbrokers

- Updated:

There’s no shortage of cryptocurrency information out there. In fact, the sheer volume can overwhelm even seasoned traders, let alone someone just starting out. If you’ve been searching for a clear, step-by-step guide on how to trade cryptocurrencies, you’re in the right place.

Instead of drowning you in endless jargon, this guide strips things back to the essentials. We’ve kept it simple, practical, and easy to follow—without leaving out the details that actually matter.

What is cryptocurrency?

Cryptocurrency is a type of digital money that relies on cryptography for security. Most cryptocurrencies run on decentralized networks built on blockchain technology. A blockchain is essentially a shared ledger, maintained across a web of computers spread around the world.

What makes cryptocurrencies unique is that they aren’t issued or controlled by any central authority, like a government or bank. This independence makes them resistant to outside manipulation or interference—one of the biggest reasons they’ve gained so much attention.

In this guide, you’ll find everything you need to kick-start your cryptocurrency trading journey. Whether you’re completely new or simply looking to deepen your knowledge, the insights here will help you understand how to buy and sell cryptocurrencies the right way. So, let’s jump in and get started.

Put simply, cryptocurrency is a kind of virtual money—you can’t see it, hold it, or slip it into your wallet. Just like regular money, you can use it to pay for products and services, but it also comes with extra advantages.

One of the biggest is that cryptocurrency transactions are borderless. You can send digital money to anyone, anywhere in the world, as long as both of you have a crypto wallet. (Don’t worry—we’ll cover what a wallet is later in this guide.)

Another key feature is control. With cryptocurrency, you have complete authority over your own money. There’s no government, central bank, or third party interfering with your funds. Your finances remain in your hands alone.

Behind the scenes, most cryptocurrencies run on blockchains—specialized technologies designed to keep every transaction secure, transparent, and tamper-proof.

Cryptocurrencies are a form of digital money that run on networks of computers spread across the globe. Because they’re decentralized, no single authority—like a government or central bank—can fully control or regulate them.

The term cryptocurrency comes from the word encryption, which refers to the advanced security methods used to protect the network and keep transactions safe.

Cryptocurrencies can be used to make secure online payments, with each transaction recorded on a digital ledger and represented in the form of tokens. The “crypto” part of the word comes from the cryptographic methods that protect these transactions. Techniques like public–private key pairs, elliptic curve encryption, and hashing functions all work together to keep the system safe and reliable.

Examples of Cryptocurrency

The first cryptocurrency to successfully use blockchain technology was Bitcoin, launched in 2009. Today, it remains the most valuable digital asset and, as of April 2025, still holds a dominant market share of more than 64 percent according to TradingView.

Since Bitcoin’s debut, thousands of other cryptocurrencies, often called altcoins, have been created, each designed with different purposes and applications. At the height of the boom in early 2022, the number of digital coins soared, but by 2023 that figure had settled at around 9,000.

It’s worth noting, however, that the vast majority of these coins have little to no influence. Estimates suggest nearly 20,000 cryptocurrencies have been launched over the years, but many are now inactive. In reality, only about 20 major cryptocurrencies dominate the market, making up close to 90 percent of its total value. The reason for such a long list of smaller, often irrelevant tokens lies in how easy it is to create a new cryptocurrency.

Below, we’ll highlight some of the most widely traded digital currencies you’re likely to encounter.

Currency | Symbol | Launch Date | Market Cap (April 24, 2025) |

Bitcoin | BTC | 2009 | $1.84 trillion |

Ethereum | ETH | 2015 | $214.02 billion |

Binance Coin | BNB | 2017 | $85.3 billion |

Cardano | ADA | 2017 | $24.23 billion |

Tether USD | USDT | 2014 | $145.68 billion |

Ripple | XRP | 2012 | $125.69 billion |

Dogecoin | DOGE | 2013 | $25.84 billion |

Cryptocurrency designation: money or security?

Although many people see cryptocurrencies as a form of money, the U.S. Internal Revenue Service (IRS) classifies them as assets or securities. This means that any profit you make from trading or investing in crypto is considered taxable income.

In fact, the U.S. Department of Treasury has proposed stricter reporting rules, requiring taxpayers to report any cryptocurrency transaction worth $10,000 or more to the IRS. The exact tax rate you pay depends on two main factors: how long you held the asset before selling it, and the type of transaction or service you engaged in within the crypto market.

Origin of Bitcoin

What we now know as Bitcoin was introduced in 2008 by an unknown person or group using the pseudonym Satoshi Nakamoto. The currency itself began circulating in 2009 when its first open-source software was released. Since then, new bitcoins have been generated through a process called mining.

As of April 24, 2025, there are about 19.86 million bitcoins in circulation, giving it a market capitalization of around 1.84 trillion dollars. This number, however, changes frequently as it depends on market conditions. The supply of Bitcoin is capped at 21 million, which adds to its security and prevents inflation or manipulation through unlimited issuance.

Although Bitcoin is only one among thousands of cryptocurrencies, it remains the most dominant. Following its launch, a wave of other digital coins—often referred to as altcoins—emerged, including Litecoin, Cardano, EOS, IOTX, DENT, Ethereum, and many others. By April 2025, the total value of all cryptocurrencies worldwide was estimated at more than 2.88 trillion dollars, with Bitcoin alone accounting for 64.3 percent of the market share.

Bitcoin is the first cryptocurrency created by an individual or group of individuals hiding under the pseudonym “Satoshi Nakamoto.” Any coin that is not Bitcoin is regarded as an “altcoin”, short for “alternative coin”.

Common cryptocurrency terms

Just like any other financial market, the crypto world comes with its own set of terms and jargon. Traders and investors often use this language when analyzing the market or discussing investment strategies. To follow along with these conversations—and to trade with confidence—it’s important to understand the key terms. Below, we’ve listed some of the most common ones you’ll come across.

ATH & ATL

“ATH” stands for All-Time High. This refers to the highest price an asset has ever reached in its history. For traders, keeping track of ATH levels is useful because it helps avoid buying at overly inflated prices or entering the market right when an asset is peaking. On the flip side, “ATL” means All-Time Low. This represents the lowest price an asset has ever traded at. When a cryptocurrency hits its ATL, it signals that the market values it at its weakest point in history.

Bear/Bearish

If you hold a bearish bias toward an asset, it means you expect its price to fall. Traders with this view usually take short positions, hoping to profit as the value declines. In market terms, someone with this outlook is called a “bear.”

Blockchain

A blockchain is a digital ledger made up of a chain of blocks, with each block containing verified transactions. The system is designed to be both decentralized and immutable—once a transaction is recorded, it cannot be deleted or altered. The idea of blockchain first emerged in 2008 with the release of Bitcoin’s whitepaper, and it has since become the foundation of most cryptocurrencies.

Distributed Ledger

A distributed ledger is a type of record-keeping system where information is shared and stored across multiple devices rather than in a single location. One of the best-known examples is blockchain, which was originally developed to record and verify all Bitcoin transactions.

P2P

P2P stands for peer-to-peer. It refers to a system where two parties can carry out transactions directly with each other, without the involvement of a third party or intermediary. In this setup, a buyer and seller interact and complete the exchange through the P2P service itself.

Escrow

An escrow is a trusted third party that temporarily holds funds on behalf of two parties during a transaction. This setup is often used when the buyer and seller don’t fully trust each other. The buyer sends money to the escrow, and once the seller fulfills their agreed obligation—such as delivering a product or service—the escrow releases the funds to them.

Fiat Currencies

Fiat currencies are traditional, government-issued forms of money. They are centralized, meaning they are controlled by a nation’s central authority and physically printed or minted. Common examples include the US dollar, the Japanese yen, and the British pound.

Exchanges

Exchanges are online platforms where cryptocurrencies are bought and sold. They act as marketplaces, connecting buyers and sellers who want to trade different digital assets. For most people, crypto exchanges are the quickest and easiest way to get started with buying or selling cryptocurrencies.

FOMO

“FOMO” stands for the fear of missing out. It describes the rush investors feel when they start buying an asset simply because they’ve heard or seen hype—often online—that its price is about to rise. This behavior is similar to panic buying, as people jump in quickly to avoid missing the opportunity. The problem is that trading based on FOMO can be risky. In many cases, it leads to buying into a manipulated or overinflated market, which can hurt your portfolio instead of growing it.

Fork

A fork occurs when the rules or protocols of a digital asset are changed by developers. These updates can take two main forms: soft forks and hard forks. A hard fork happens when the changes are so significant that the old protocol can no longer work with the new one. This essentially creates a new, separate blockchain and often results in the creation of a new cryptocurrency. In contrast, a soft fork is a more minor update. It remains backward-compatible, meaning older nodes can still recognize and accept the new blocks as valid.

FUD

“FUD” stands for fear, uncertainty, and doubt. It refers to situations where negative or misleading information is spread about an asset, often with the intention of driving its price down. Once the market reacts and the price falls, those behind the rumors can take advantage by buying the asset at a cheaper price.

HODL

“HODL” may look like a typo, but in the crypto world it stands for “Hold On for Dear Life.” The term was coined by traders to describe the strategy of holding onto assets rather than selling them during periods of high volatility. A trader who is hodling believes that, despite short-term price swings, the value will eventually rise in the long run.

Initial Coin Offering

An Initial Coin Offering, or ICO, is a way for new cryptocurrency projects to raise capital. During an ICO, a coin is introduced to the public and made available for purchase, often before it is officially listed on major exchanges. It’s similar to how a company issues shares to the public when it goes public, giving early investors the chance to buy in at the start.

KYC

Know Your Customer, or KYC, is the process exchanges use to verify the identity of their users. It’s a regulatory requirement designed to protect customers and prevent illegal activities such as money laundering, fraud, and terrorist financing. By completing KYC, traders confirm their identity through documents like IDs, passports, or proof of address before they can fully access an exchange’s services.

Long/Long Position

Taking a long position, or “going long,” means you expect the price of an asset to rise. For example, if you go long on Ethereum, you’re buying it with the belief that its value will increase over time, allowing you to sell later at a profit.

Short/Shorting

Shorting an asset means you expect its price to fall. Traders profit from this by either selling the asset first and buying it back at a lower price, or through financial instruments like put options. However, shorting is considered a high-risk strategy—especially in the volatile crypto market—since losses can grow quickly if prices rise instead of fall.

Market Cap

Market capitalization, or market cap, is the total market value of a cryptocurrency. It is calculated by multiplying the total number of coins in circulation by the current market price. For example, Bitcoin’s market cap equals the number of bitcoins in existence multiplied by its current price. Since prices fluctuate constantly, the market cap of any cryptocurrency changes along with market conditions.

POS

Proof of Stake (PoS) is a consensus mechanism used to verify transactions on a blockchain. Instead of relying on energy-intensive mining, as in Proof of Work (PoW), PoS selects validators based on the amount of cryptocurrency they have staked, or locked up, in the network. The higher the stake, the greater the chance of being chosen to validate transactions and earn rewards, typically in the form of transaction fees or newly issued tokens. Popular cryptocurrencies such as Ethereum, Cardano, and Solana use PoS to secure their networks and process transactions efficiently.

POW

Proof of Work (PoW) is a consensus mechanism used to verify and confirm transactions on a blockchain. In PoW systems, miners compete to solve complex mathematical problems, and the first to solve it gets the right to add a new block of transactions to the blockchain. As a reward for their computational effort, miners receive newly issued coins along with transaction fees. Cryptocurrencies like Bitcoin, Litecoin, and Dogecoin all rely on PoW to secure their networks and validate transactions.

Noob

A noob, short for “newbie,” is a term used to describe someone who is new to trading or cryptocurrency. It often refers to beginners who are still learning how markets work and gaining experience before making informed decisions. Since crypto markets can be highly volatile, noobs are encouraged to study and practice carefully before getting deeply involved.

Moon/Mooning

Moon or “mooning” is a slang term used in crypto to describe a rapid increase in the value of an asset. For example, when a coin’s price rises sharply, traders might say it is “going to the moon.”

Mining Incentive

Mining incentives are rewards given to miners who confirm transactions and add them to blocks on the blockchain. For example, Bitcoin miners invest in specialized hardware and cover high electricity costs to participate in mining. As compensation for this work, they receive tokens, which serve as their wage for maintaining the network.

Rekt

When an investor loses a significant amount of money from holding an asset, they are said to be rekt, a slang term for “wrecked.”

ROI

ROI stands for Return on Investment. It measures how much profit or loss you have made from your cryptocurrency investment, which can be either positive or negative.

Pump and Dump

Pump and dump is a type of market manipulation where a group of traders or investors artificially inflate the price of an asset. They create false hype or trading activity to make others buy in, causing the price to rise (pump). Once the price is high, they quickly sell off their holdings (dump) for profit, leaving unsuspecting traders with devalued or worthless coins. It’s important to watch out for these schemes and avoid getting caught in them.

Token

Digital assets that operate on their own blockchain are called coins (such as Bitcoin, ADA, or BNB). On the other hand, assets built on top of existing blockchains are known as tokens, and many of them are designed for specific functions within their ecosystem.

Whale

A whale refers to an individual or entity that holds or trades a large volume of cryptocurrency. Because of their significant holdings, whales can influence market prices, sometimes causing sudden spikes or drops. The term is metaphorical, as whales are seen as creating big waves in the ocean of the crypto market.

White Paper

White papers are detailed documents that provide comprehensive information about a digital asset, including its underlying technology, purpose, and ecosystem. They serve as a guide for traders and investors to understand how the asset works, its potential use cases, and the problems it aims to solve.

Some benefits and shortcomings of cryptocurrencies

As with most things in life, cryptocurrencies come with a lot of benefits, as well as some demerits. We outline their main advantages and disadvantages below.

Benefits

Cryptocurrencies allow two parties to transfer funds quickly without relying on intermediaries such as banks or credit card companies. Transactions are secured through public and private keys, as well as consensus mechanisms like proof of stake (PoS) and proof of work (PoW). Users typically store their digital coins in a cryptocurrency wallet. Each wallet has a public key, which acts like an address for receiving funds, and a private key, which is known only to the owner and used to authorize transactions. Transaction fees in cryptocurrencies are usually much lower compared to the fees charged by traditional banks.

Shortcomings

Because cryptocurrencies are semi-anonymous, they are sometimes used for illicit activities such as tax evasion and money laundering. Although often praised for offering privacy and protection against government oversight, the actual level of anonymity varies greatly between different coins. For instance, Bitcoin is not an ideal choice for illegal transactions, as its blockchain is transparent and allows authorities to trace transaction histories. In contrast, privacy-focused coins like Monero and shielded Zcash use advanced cryptographic methods that make tracing significantly more difficult. However, achieving complete and absolute untraceability in practice remains a challenge.

Benefits | Shortcomings |

Easy to transfer funds directly between two parties | Some crypto networks are used for illegal transactions. |

Transactions are secure. | Crypto funds can be easily lost forever if the crypto wallet’s password is forgotten. |

Transaction fees are relatively small. |

What is a cryptocurrency wallet, and what are the types?

Unlike a traditional bank account that holds your funds, a cryptocurrency wallet is a digital tool that stores your private keys, allowing you to access and manage your assets on the blockchain. Setting up a wallet is essential for handling cryptocurrency, as it safeguards your keys and authorizes transactions.

With a wallet, you can send and receive crypto, as well as use it to pay for goods and services. Access is typically secured with a password or PIN, while your private keys enable you to approve transactions.

Wallets come in various forms: mobile wallets for everyday use, such as online shopping; desktop wallets for managing funds on a computer; and hardware wallets, which are physical devices designed for maximum security.

How do crypto wallets work?

Crypto wallets are different from physical wallets because, instead of storing money, they store private and public keys. Think of public keys like your bank account number, while private keys act like the PIN you use to authorize transactions.

When you send coins to someone’s wallet address, you’re essentially transferring ownership of those coins on the blockchain. For the recipient to spend them, their private keys must match the public address where the coins were sent.

This means that whoever holds the private keys has full control over the funds associated with that wallet. That’s why keeping your private keys safe is critical—if someone else gains access, they can transfer your coins to their own wallet.

It’s equally important to back up your private keys. If they’re lost and unrecoverable, your funds are gone forever. Many investors have lost millions simply because they misplaced or failed to back up their keys.

Types of Crypto Wallets

There are many types of crypto wallets. Each type operates differently, with its own advantages and disadvantages. Below are some of the main ones you can choose from.

Online wallets

Online wallets are digital wallets connected to the internet and hosted on a server. They allow you to access your cryptocurrency from any device through a web browser, as long as you are online. While they are convenient and easy to use, their security can be vulnerable. If the online platform is hacked or if your account lacks strong protection, your funds may be at risk.

Desktop wallets

Desktop wallets are software applications installed directly on your computer, allowing you to store your private keys locally. This gives you greater control compared to online wallets, but the level of security depends heavily on the safety of your computer. If your device is infected with malware, compromised by hackers, or accessed without authorization, your wallet and funds could be at risk.

Mobile wallets

Mobile wallets are smartphone applications that provide a convenient way to access and manage your crypto on the go. They store private keys locally on the device, making transactions quick and easy. However, their security is only as strong as the security of your phone. Risks such as malware, hacking attempts, or losing the device altogether can put your funds at risk if proper safeguards—like PINs, biometrics, and backups—are not in place.

Hardware wallets

A hardware wallet is a physical device that stores your private keys offline, keeping them safe from online threats. You can connect it to your computer via USB to make transactions. Hardware wallets are generally considered more secure than other wallet types, making them ideal for storing larger amounts of cryptocurrency. The main drawback is cost, as they require purchasing a dedicated device.

Paper wallets

A paper wallet stores your public and private keys on a physical piece of paper. Because it is completely offline, it can be a secure option for long-term storage. However, it is not practical for everyday use and is vulnerable to physical damage, loss, or theft.

Custodial wallets

A custodial wallet is one where a third party, such as a cryptocurrency exchange or service provider, holds and manages your private keys for you. This setup offers convenience, but it also means you are trusting that third party to keep your funds secure.

Non-custodial wallets

A non-custodial wallet gives you full control over your private keys. You are entirely responsible for keeping them secure and backed up. This approach provides greater autonomy and independence from third parties, but it also means that the safety of your funds depends entirely on how well you manage your keys.

It’s important to note that cryptocurrency wallets are usually designed to support specific blockchains and their native coins or tokens. Sending a cryptocurrency to a wallet that doesn’t support that asset can cause the funds to not appear and may make recovery difficult—or even impossible—without advanced technical knowledge and access to the private keys.

Wallet | How to access it | How secure |

Online wallet | Third-party online servers | Somewhat secure |

Desktop wallet | Software installed on PC | Quite secure |

Mobile wallet | Wallet app on mobile device | More secure than online wallets |

Hardware wallet | Physical USB-like device | Very secure |

Paper wallet | QR-code or keys printed on a paper | Very secure but outdated |

Cryptocurrency trading vs. investing: which is better?

As you begin your crypto trading journey, it’s essential to be clear about your goals—whether you aim for short-term gains or long-term holdings.

Cryptocurrency trading involves speculating on the short-term price movements of digital coins. This can be done either by buying and selling coins directly on a crypto exchange or by trading contracts for difference (CFDs) with a broker. CFDs let you speculate on price changes without owning the underlying asset. You can go long or short and even use leverage, meaning you only need a fraction of the asset’s value, known as margin, to trade. However, leverage can amplify both profits and losses, so it can be a double-edged sword depending on market movements.

A common long-term strategy is investing by holding assets for years, sometimes indefinitely—a practice popularly called “HODLing.” Similar to a buy-and-hold strategy with stocks, investors purchase coins they believe will grow in value and retain them for the long term, selling only when necessary.

Both trading and investing have their advantages. The choice depends on your financial goals and risk tolerance. Those comfortable with higher risk may prefer active trading, while more conservative investors often opt for a buy-and-hold approach.

Trading | Investing |

Short term | Long term (HODL) |

For those with a high risk tolerance | For conservatives |

Directly with the coins or indirectly via CFDs | Directly with the coins |

Can use leverage to increase potential profits | Not available |

Crypto market versus the stock market

Now, let’s compare the cryptocurrency market to the stock market.

How is the crypto market similar to the stock market?

While the cryptocurrency market and the stock market differ in many ways, they share several similarities.

First, both are considered security markets by tax authorities, and profits from trading or investing in them are taxable based on the duration of your trades. Tax rules for cryptocurrency vary depending on your country, so it’s important to stay informed.

Second, trading and investing strategies are largely similar in both markets. Cryptocurrency traders can engage in scalping, day trading, or swing trading, while crypto investors can adopt a buy-and-hold strategy for long-term growth, much like stock investors.

Third, the analytical tools used in crypto trading mirror those in the stock market. Charts and technical indicators, which will be discussed later in this guide, are commonly used to analyze price movements and make informed decisions.

Fourth, although the cryptocurrency market is relatively new compared to the centuries-old stock market, it already offers derivative products such as futures and options. Additionally, just as the stock market is valued in fiat currencies, the crypto market is often measured against fiat currencies like the US dollar or euro.

Crypto Market | Stock Market | |

Taxable security | ||

Short-term trading and long-term investing | ||

Technical analysis tools used | ||

Derivative products |

The difference between the cryptocurrency market and the stock market

Despite their similarities, the cryptocurrency and stock markets are very different. Success in one market does not guarantee success in the other. The following are the key areas where they differ.

Volatility

The cryptocurrency market is highly volatile, often experiencing large price swings in a short period. Double-digit percentage changes within hours or days are not uncommon. In contrast, the stock market tends to be more stable and experiences less extreme fluctuations.

Market securities or assets

In the stock market, you buy shares that represent ownership in publicly listed companies. In contrast, the cryptocurrency market involves purchasing digital currencies or investing in the underlying technology and concepts, rather than acquiring ownership in a traditional company.

Regulations

The stock market has the advantage of decades of regulatory oversight, with well-established rules and guidelines governing its operation. By comparison, the cryptocurrency market, being less than two decades old, faces ongoing regulatory challenges. The absence of comprehensive regulations contributes to its high volatility and limited oversight.

Market maturity

Age plays an important role in financial markets. The stock market has been active for centuries, while the cryptocurrency market is still in its second decade. Trading volume and overall market value in the stock market are much larger than in the crypto market. The relative youth of cryptocurrencies is one of the factors contributing to their high volatility.

Crypto Market | Stock Market | |

Volatility | Very high | Normal |

Assets | Crypto coins, tokens, and technology | Shares of companies |

Regulations | Poor | Adequate |

Maturity | About a decade | Many centuries |

Various cryptocurrency markets

There are two categories to trade in the cryptocurrency market: the spot market and the derivatives market.

Crypto spot market

In the cryptocurrency spot market, coins or tokens are bought or sold for immediate delivery. When you trade in the spot market, you actually own the assets, meaning your profit depends on the increase in value of the assets in your portfolio.

For example, if you buy 1 BTC at $92,471, you pay the full amount and receive 1 BTC in your wallet. If the price rises and you sell, you make a profit; if it falls, you incur a loss.

The spot market operates with two key types of participants: makers and takers.

A maker is a trader who adds liquidity to the market by placing a limit order that is not immediately filled. For instance, if a trader wants to sell a coin at a price slightly above the current market value, the order will remain in the order book until a buyer is willing to meet that price. This “makes” a new price point and adds depth to the market.

A taker, on the other hand, is a trader who removes liquidity by placing a market order that is executed immediately at the best available price in the order book. Whether buying or selling, taking the fastest available execution consumes existing liquidity.

Both buyers and sellers can act as makers by setting limit orders or as takers by executing market orders. Makers provide liquidity and help ensure smoother trading, which is why they usually incur lower exchange fees compared to takers.

Crypto derivatives market

Cryptocurrency derivatives are financial contracts whose value is derived from an underlying asset, which can also include other derivatives. These contracts are linked to existing assets like Bitcoin, ADA, Dent, and others, with their price reflecting the value of these underlying assets.

There are several types of derivatives in the crypto market, including leveraged tokens, futures contracts, options contracts, and contracts for difference (CFDs). Due to their leveraged nature and complexity, cryptocurrency derivatives carry significantly higher risks compared to spot market trading, making them more suitable for experienced traders.

Crypto spot market | Crypto derivatives market |

You own the asset | May not own the asset in most situations |

Traded at face value | Traded on margin |

Leverage unlikely | Leverage is available |

The bid-ask spread

The bid-ask spread is the difference between the highest buy price (bid) and the lowest sell price (ask) in a market. It reflects the lowest price a seller is willing to accept and the highest price a buyer is willing to offer. In the order book, the spread represents the gap between the highest buy limit order and the lowest sell limit order.

The width of the spread is an indicator of market liquidity. A narrower spread suggests higher liquidity, meaning it’s easier to buy and sell the asset without significantly affecting its price. The spread also provides insight into supply and demand, with the sell-side representing supply and the buy-side representing demand.

Common chart types

A chart is a visual representation of data — in this case, price movements over time. There are many types of charts used to analyze the cryptocurrency market, but the most popular are the Japanese candlestick chart, the bar chart, and the line chart. Other types, such as point-and-figure charts and Renko charts, also exist, but this section will focus on the three most commonly used charts.

Candlestick chart

The Japanese candlestick chart visually represents price movements during a trading session using candlesticks, which consist of a body and upper and lower wicks based on price action for that period. Each candlestick corresponds to a specific timeframe. For example, a 10-minute candlestick chart shows candles representing 10-minute trading sessions, while a 1-hour chart displays the price action for each 1-hour session.

A Japanese candlestick contains four key data points: the opening price, lowest price, highest price, and closing price. The opening price is the first price recorded within a specific trading session, while the closing price is the last price before the current candlestick ends and the next one begins to form.

One interesting feature of the candlestick chart is that it can be color-coded to indicate whether a trading session closed bullish or bearish. While you can customize the colors, the most commonly used are green or white for bullish candlesticks and red or black for bearish ones. The wicks, also called shadows, are the thin lines extending above and below the candlestick body, showing the highest and lowest prices reached during the trading session relative to the opening and closing prices.

Bar chart

A bar chart is a graphical representation of price fluctuations, with individual price bars representing price action over a specific timeframe. Each bar consists of a vertical line showing the lowest and highest prices for that period, along with small horizontal marks indicating the opening and closing prices. Like Japanese candlestick charts, a 10-minute bar chart displays the price action for every ten minutes. Each bar also contains four key data points: open, high, low, and close.

Line chart

A line chart represents the price of an asset using a single, continuous line. Most commonly, the closing prices of trading sessions are used to plot the line, although other price points — such as open, high, or low — can also be used. By focusing on the closing price, line charts make it easier to identify overall trends, making them especially useful for observing the general movement of the market.

Comparing the three common chart patterns

Candlestick Chart | Bar Chart | Line Chart | |

Shows individual trading sessions | Yes | Yes | No (it is a continuous line) |

Color-coded | Yes | Yes | No |

Price points shown | 4 (open, low, high, and close) | 4 (open, low, high, and close) | 1 (mostly close but can be any of the 4 price points) |

Why trade cryptocurrencies?

Despite the negative publicity surrounding the cryptocurrency market since its emergence, many people continue to trade crypto. So, what attracts traders to this market? Here are some key reasons why you might consider exploring it.

Round-the-clock access

Unlike the stock market, which operates during set weekday trading hours, the decentralized nature of cryptocurrency exchanges allows trading 24 hours a day, seven days a week. This continuous availability enables traders to operate at their convenience and even use trading algorithms for automated, round-the-clock market activity.

Easy to open an account

Opening a cryptocurrency trading account is often simpler than setting up a traditional stock brokerage account. Some exchanges may initially require only an email address to sign up. However, depending on your jurisdiction and the exchange’s policies, Know Your Customer (KYC) verification — which involves submitting identification documents — is usually required to access full trading features and higher withdrawal limits.

Wide varieties of assets to trade

Despite its relatively young age, the cryptocurrency market has grown significantly. Today, most financial instruments commonly found in the stock market can also be traded in the crypto market. These include leveraged tokens, options, futures, CFDs (Contracts for Difference), and swaps. Essentially, any type of derivative you are looking to trade is available in the cryptocurrency market.standardized contracts traded on public exchanges. The terms are fixed, and they’re regulated, which adds a layer of transparency. The main difference? Forwards are private and customizable, while futures are public and standardized.

Market volatility

Volatility in the cryptocurrency market can actually be an advantage for traders. Setting aside the risks for a moment, high volatility can lead to quick gains. Greater price swings create more trading opportunities, allowing traders to potentially profit from rapid market movements.

There’s some degree of privacy and anonymity

If privacy is important to you, the cryptocurrency market may be appealing. Unlike stock trading, which requires opening an account with personal documents, some crypto exchanges do not store your data or have access to your funds. However, certain centralized exchanges still require you to provide some personal information.

Cryptocurrency trading techniques

There are two main methods for analyzing and trading financial markets, both of which have been around for a long time and are now widely applied to the cryptocurrency market. These methods are fundamental analysis (FA) and technical analysis (TA). While each technique can be used independently, most traders combine both to make more informed decisions.

Understanding fundamental analysis (or FA)

Fundamental analysis (FA) is the process of evaluating financial and economic factors that directly impact a security to predict its future value. FA helps determine whether an asset is overvalued or undervalued at its current market price. This insight can guide decisions on whether to invest in the asset or how long to hold it if you already own it.

In cryptocurrency trading, FA involves examining both on-chain and off-chain metrics. On-chain metrics include data such as active and inactive wallet addresses, network fees, network hash rate, transaction volumes, and token issuance rates. While this information may seem overwhelming, platforms like Bitinfocharts.com make it easy to access and analyze.

Off-chain metrics, on the other hand, focus on external factors like exchange listings, community engagement, regulatory developments, the underlying technology, and the cryptocurrency’s intended purpose and adoption potential. Together, these metrics provide a comprehensive view of a coin’s value and prospects.

Understanding technical analysis (or TA)

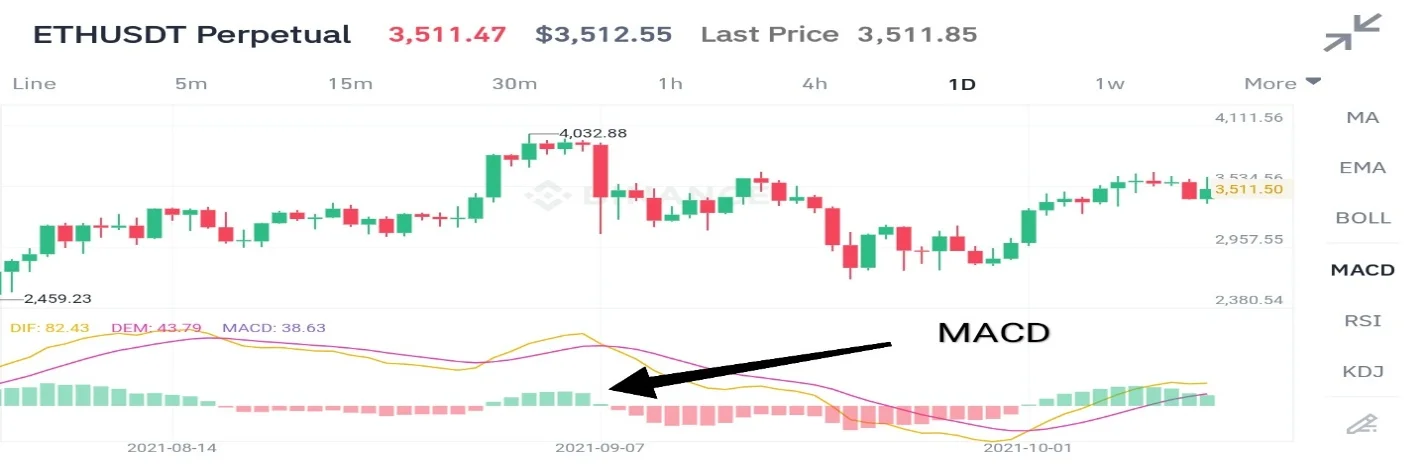

Technical analysis (TA) is a trading method where traders use charting software and technical indicators to study historical price movements and patterns, aiming to predict future price behavior. Common indicators include moving averages, MACD (Moving Average Convergence Divergence), and RSI (Relative Strength Index). Other tools frequently used are candlestick patterns, chart patterns, support and resistance levels, trend lines, and Fibonacci retracements.

TA can be applied across any timeframe and trading style, from scalping to long-term investing. The key focus for traders is understanding the market condition — determining whether it is trending or range-bound — to make informed trading decisions.

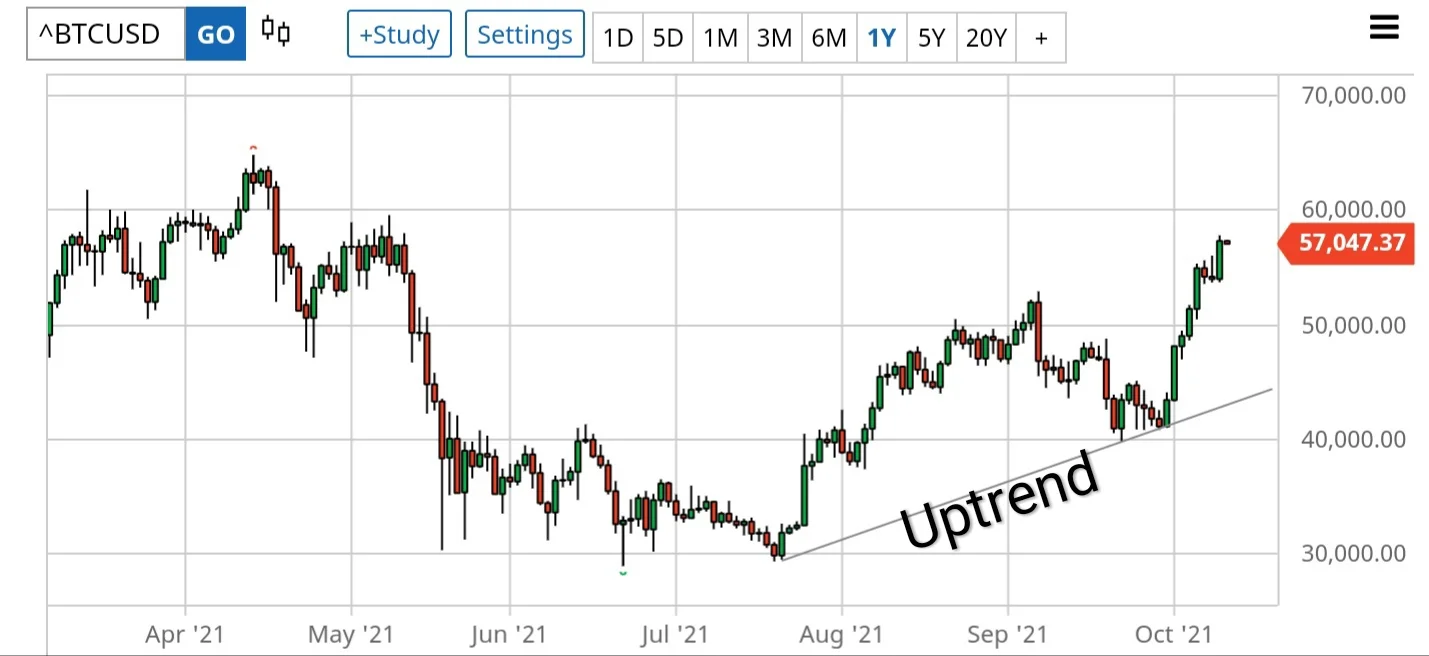

A trending market

A trending market shows a general upward or downward movement. While the trend can often be identified by observing price action, many traders rely on tools like moving averages and trend lines to clearly define it.

Market trends are generally categorized into two types: bull markets and bear markets. A bull market is characterized by an uptrend, where prices are generally rising, while a bear market is defined by a downtrend, where prices are generally falling.

It’s important to note that markets rarely move in a straight line. Temporary declines can occur during an uptrend, and brief rallies can happen during a downtrend. The timeframe you analyze also matters: an asset may be in an uptrend on an hourly chart but in a downtrend on a daily chart. Trends observed on higher timeframes carry more weight than those on lower timeframes.

Range-bound market

A market is considered range-bound when it moves sideways, showing no clear direction — neither an uptrend nor a downtrend. This type of market is also referred to as trendless, horizontal, or ranging.

In a range-bound market, prices oscillate within a defined range. The upper boundary of this range acts as a resistance zone, where prices struggle to break above, while the lower boundary serves as a support zone, preventing prices from falling below it.

Common technical analysis tools and indicators

Technical indicators are mathematical calculations derived from market data, which can include price, trading volume, volatility, on-chain metrics, and open interest. Indicators are typically classified as either leading or lagging, depending on whether they predict price movements or follow them.

While most indicators are price-based, some focus on trading volume, such as on-balance volume, open interest, and accumulation/distribution metrics. Price-based indicators can be further grouped into trend indicators, like moving averages and average directional index (ADX); oscillators, such as CCI, RSI, and Stochastic; and momentum indicators like the MACD.

Trend lines

Trend lines are a widely used tool by traders and chartists. They are diagonal lines drawn on charts to connect significant price points, though some traders also apply them to other technical indicators.

The main purpose of trend lines is to help identify the market trend and better understand its structure. They can also serve as dynamic support and resistance levels. Trend lines can be applied to any timeframe, but those drawn on higher timeframes are generally more reliable than ones on lower timeframes. A trend line is considered valid only if the price touches it at least twice; otherwise, it may be deemed unreliable.

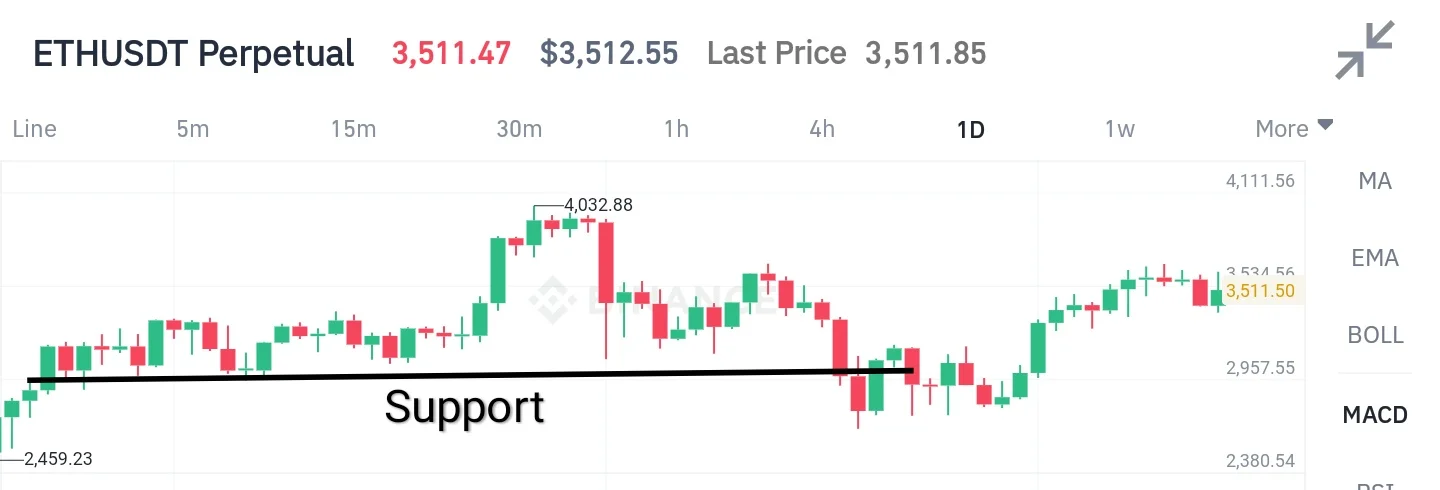

Support and resistance levels

Support and resistance are key concepts in technical analysis. The support level acts as a floor for prices, where the market tends to bounce upward. It represents an area of increased demand, where buyers step in and push prices higher.

A resistance level, in contrast, acts as a price ceiling. It is an area with significant supply, where increased selling pressure tends to push the price downward.

In short, support represents a level of increased demand, while resistance represents a level of increased supply. However, these levels are not fixed and can change over time. For instance, when the price breaks above a resistance level, that level often begins to act as a new support level.

Beyond using trend lines and horizontal lines to identify support and resistance, traders also rely on technical indicators to guide their analysis. Let’s explore some of the most commonly used indicators.

Moving averages

Moving averages are technical indicators that help smooth out price action and identify market trends. They are considered lagging indicators because they are based on historical price data.

The two most popular types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Both serve to smooth prices, but they differ in how they are calculated, with the EMA giving more weight to recent price data compared to the SMA.

The Simple Moving Average (SMA) is calculated by taking the average of price data from a specific number of periods. For example, a 100-day SMA takes the average price of the last 100 days and plots it as a line on the chart.

The Exponential Moving Average (EMA), on the other hand, gives more weight to recent price data, making it react faster to market movements compared to the SMA.

While moving averages are valuable tools for identifying trends and potential entry or exit points, they should not be used in isolation due to their lagging nature. Combining them with other indicators can improve the accuracy of your trading decisions and increase the probability of success.

Oscillators

Oscillators are technical indicators that fluctuate around a central line or within defined upper and lower limits. They are primarily used to identify whether an asset is overbought or oversold. When the indicator reaches the upper extreme, the asset is considered overbought, whereas reaching the lower extreme indicates it is oversold.

Common examples of oscillator indicators include the Relative Strength Index (RSI), Williams %R, Stochastic Oscillator, Commodity Channel Index (CCI), Momentum, and the Moving Average Convergence Divergence (MACD).

FA vs. TA – which is better for trading?

Whether you use fundamental or technical analysis depends on your trading style and preferences. If you are a trader who typically enters and exits positions quickly within a single day, technical analysis will likely be your primary approach. However, this does not mean you cannot incorporate news or events into your trading decisions.

Conversely, if you prefer to research and make decisions based on the core information about an asset, such as its technology, adoption potential, or regulatory developments, then fundamental analysis is a more suitable choice.

Fundamental Analysis | Technical Analysis |

Considers economic and other factors to estimate the present and future worth of the asset | Uses previous price action to forecast future price movements |

Suitable for ascertaining the long-term outlook of the asset | Mostly focused on short-term and medium-term price movements |

Requires deliberate research into the factors that can affect the asset | Focuses on the market data (mostly price and volume) |

Used for gauging the long-term direction of the market | Used for timing entry and exits |

Using both fundamental analysis (FA) and technical analysis (TA) can be more effective than relying on just one approach. As a cryptocurrency trader, having a diverse set of tools in your trading arsenal increases your chances of success. Integrating FA and TA into your trades allows you to better spot opportunities in the crypto market, as the two approaches complement each other.

For example, FA can help you determine the overall long-term direction of the market. However, it doesn’t provide precise guidance on the best moments to enter or exit a trade. This is where TA becomes useful, allowing you to time your entry and exit based on price action and market patterns.

Conversely, when using TA to make short-term trading decisions, FA can confirm whether your trades align with the market’s long-term outlook. By combining both techniques, you gain a more complete perspective, improving your decision-making and reducing the risks of relying on a single method.

Types of trading orders

To buy or sell cryptocurrency, you need to instruct the exchange on how to execute your orders. For immediate execution, you can place a market order, which will buy or sell at the best available price. In other cases, you may want to trade only when the price reaches a specific level. Below are some of the most common types of orders used in cryptocurrency trading.

What is a market order? A market order is an instruction to buy or sell a cryptocurrency at the best available price in the market. This type of order is executed immediately, regardless of whether the price has risen or fallen. While market orders guarantee fast execution, they may result in a slightly less favorable price compared to the expected value.

What is a limit order? A limit order is a buy or sell order that is executed only at a specified price or a better one. For a limit buy order, the order must be placed below the current market price and will execute at the specified price or lower. Conversely, a limit sell order is placed above the current market price and executes at the specified price or higher. For example, if BTC is trading at $92,000 and you anticipate a temporary dip, you could place a limit buy order at $91,000. The order will only be filled when the price reaches $91,000 or lower, never higher. Limit orders allow traders to take advantage of favorable price levels, but the downside is that the market may not reach your specified price, or it may take longer to execute. Understanding how limit orders work is essential to using them effectively in crypto trading.

What is a stop-loss order? A stop-loss order is an instruction to exit a position if the market moves against you to a certain level. Its main purpose is to limit potential losses. As a trader, you should always have an invalidation point — the price at which you accept that your trade idea is wrong. For example, suppose you place a limit order to buy 1 Bitcoin at $55,600. You could set a stop-loss at $54,850. This means that if the market price falls below your entry point, the stop-loss order triggers, automatically closing your trade to limit your loss. Using a stop-loss order helps protect your capital, preventing catastrophic losses or complete liquidation of your trading account.

It’s important to understand that a stop-loss order is not foolproof. In certain situations, such as when the price gaps below your stop-loss level, the order may not be triggered at the intended price. Despite this limitation, setting a stop-loss is still highly recommended. To further protect your capital, always monitor your trades and keep your position sizes manageable to reduce potential losses.

Knowing when to buy and sell

Knowing when to buy or sell is not an easy skill to master, but the key is to establish clear entry and exit criteria. For instance, you might decide to buy when the market is oversold and sell when it is overbought, using a 14-period RSI indicator as your guide.

However, having a trading strategy with entry and exit rules alone is not sufficient. You should also develop a comprehensive trading plan that outlines your risk management, position sizing, and overall approach to the market.

Why do you need a trading plan?

Having a trading plan is essential to ensure you make consistent, well-informed decisions that align with your goals. Without a plan, buying and selling becomes random, and you risk acting without a clear purpose. Think of a trading plan as a map — it guides you through your cryptocurrency trading journey.

A well-defined plan also helps keep your emotions in check. One of the biggest challenges traders face is managing emotions, especially when the market moves against a position or during a series of losses. Following your trading plan helps you avoid making impulsive or irrational decisions.

Additionally, a trading plan should include a money and risk management strategy. These components are critical for long-term success, as they help preserve your trading account, allowing you to stay in the market and eventually generate profits.

Different styles of trading

Crypto traders use various trading styles, including scalping, day trading, swing trading, and position trading. Choosing the right style depends on your personality, risk tolerance, and availability. For instance, if you work a 9-to-5 job, you may not have the time to monitor the market continuously.

Let’s explore these trading styles in more detail:

Scalping

Scalping is an intraday trading strategy in which a trader aims to profit from small price movements over very short periods — ranging from a few seconds to several minutes. This approach requires constant monitoring of charts on the lowest timeframes, precise timing, and accurate entry and exit points.

Scalpers may execute anywhere from a few to hundreds of trades in a single day. Nowadays, many scalpers also rely on trading algorithms to enhance speed and efficiency.

Day trading

Day trading is a strategy where traders enter and exit positions within the same trading day. Positions are typically held for several minutes to a few hours, allowing for multiple trades before the market closes.

This style requires constant monitoring of the market, making it less suitable for those with busy schedules. The high volatility of the cryptocurrency market also makes day trading challenging for beginners. Success in day trading demands strong discipline, emotional control, and often the use of electronic trading systems to reduce errors caused by human judgment. Risk-averse traders may prefer a more conservative approach.

Swing trading

Swing trading is a strategy where traders hold positions for several days to a few weeks, aiming to capture the individual price swings within the daily timeframe. Traders may occasionally use shorter timeframes, such as the 4-hour chart, to fine-tune entry points.

This approach is more conservative than scalping or day trading because it doesn’t require constant market monitoring. It also provides the opportunity to capture larger market moves, making it suitable for traders who prefer a balanced approach between activity and convenience.

Position trading (HODL)

Position trading is a long-term strategy, often called a trend-following approach. Traders identify prevailing trends in the market and place their orders to move in the same direction as the trend. Positions are usually held for months or even years, only closing when a trend reversal is observed.

Compared to scalping and day trading, position trading requires less frequent monitoring, making it a suitable strategy for beginners. Swing trading and position trading provide more manageable risk and time commitment, while day trading and scalping are better suited for advanced traders who can handle rapid market movements.

Scalping | Day Trading | Swing Trading | Position Trading | |

Trade duration | Some seconds to a few minutes | Some minutes to a few hours | Days to weeks | Months to years |

What traders are called | Scalpers | Day traders | Swing traders | Position traders |

Timeframe | Tick chart, 1-minute, and 5-minute timeframes | 5-minute to hourly timeframe | Daily timeframe and sometimes, 4-hourly timeframe | Weekly timeframe and daily timeframe |

Time requirement | Time-consuming | Time-consuming | Less time consuming | Least time consuming |

Approach | Part-time or full-time | Full-time | Part-time | Part-time |

Margin trading (trading with leverage)

Margin trading is when a broker or exchange lets you open a position by putting up only a fraction of the total trade value, using borrowed funds to increase your market exposure. This is known as trading with leverage.

Leverage amplifies both potential profits and potential losses. For example, with 1:10 leverage, a $1,000 investment controls $10,000 worth of the asset. Many exchanges offer different leverage ratios, such as 1:10, 1:50, or 1:100. Because of the higher risk, beginner traders should fully understand how leverage works and carefully manage their positions before using it.

Risk management

The cryptocurrency market carries higher risk than most other markets because of its inherent volatility. Cryptos can experience double-digit percentage swings within a single day, making it crucial to implement proper risk management strategies to protect your capital.

Before entering a trade, you should carefully consider the timing of your purchase and define clear criteria for buying an asset. Additionally, you must pre-determine the amount of capital you are willing to allocate to each trade, ensuring that no single position can jeopardize your overall portfolio.

Managing your portfolio

Portfolio management is a critical aspect of cryptocurrency trading, as it helps you allocate capital effectively across the assets you hold. Before building a crypto portfolio, you should clearly define your expectations for each asset, both in the short term and long term.

Proper portfolio management allows you to maximize returns while minimizing risks. By continuously monitoring your holdings, you can add high-performing assets and remove underperforming ones, ensuring your investment strategy remains aligned with your financial goals.

How to pick the best cryptocurrency exchange

Numerous exchanges are available for trading cryptocurrencies, but not all are reliable. Some stand out for their quality, while others may pose risks. Here are key factors to consider when selecting a cryptocurrency exchange.

Liquidity

A cryptocurrency exchange with high liquidity ensures that trades are executed swiftly and that funds can be withdrawn easily. High liquidity also reduces the risk of market manipulation, as large trading volumes contribute to a more stable and reliable trading environment.

Security

Security must be a top consideration when selecting a cryptocurrency exchange. Several exchanges have fallen victim to hacks, resulting in the loss of hundreds of millions of dollars in digital assets. A recent example occurred in February 2025, when the major exchange Bybit suffered a breach, leading to the theft of around $1.4–$1.5 billion in Ethereum tokens. Always choose an exchange that employs robust technology to safeguard its platform and protect users’ data.

Transaction fees

It’s essential to understand an exchange’s fee structure, as it can greatly affect which trading strategies are profitable for you. For instance, scalpers or day traders face higher fees due to their frequent trades. Fees directly impact your profit margin—lower fees can boost your gains, whereas high fees can drastically reduce or even wipe out your profits.

Payment and withdrawal methods

When selecting an exchange, consider how easy it is to deposit and withdraw funds. Exchanges offering multiple payment methods—such as credit cards, cryptocurrencies, and PayPal—provide greater flexibility and convenience for traders.

User experience

The exchange’s user interface should be intuitive and easy to navigate, particularly for beginners. This includes how straightforward it is to place “buy” and “sell” orders within the platform’s order book.

Recommended platforms for your first trades

For beginners seeking a user-friendly exchange, Coinbase is an excellent choice. It offers more than just basic trading, including a self-custody wallet, staking options, institutional-grade solutions, an NFT marketplace, and educational resources. Coinbase also provides a crypto debit card and a merchant platform for accepting digital currencies, all with a strong emphasis on transparency and security.

For those looking for a professional trading experience with advanced tools and a wider range of assets, Binance is the preferred exchange. It features low maker/taker fees, over 500 tradable cryptocurrencies, and multiple order types to accommodate diverse trading strategies.

Steps to start trading cryptos

If you have made up your mind on trading cryptocurrencies, these are the steps you should follow:

Raise the capital: Only trade with funds you can afford to lose. Avoid using money earmarked for essential living expenses—such as rent, utilities, or emergency savings—since the cryptocurrency market is highly unpredictable and losses can happen quickly. Start with a small amount to familiarize yourself with the market before committing larger sums.

Create a trading plan: Trading without a plan is like navigating without a compass. Develop a trading plan tailored to your goals, trading style, and risk tolerance. This plan will guide your decisions, help prevent overtrading, and ensure effective risk management.

Register with a reputable exchange: Once you’re ready, open an account with a trustworthy and properly regulated exchange, and fund it to start your first trade. Conduct thorough research to ensure the platform is reliable and secure.

Purchase your first cryptocurrency: Now it’s time to make your first trade. Choose the cryptocurrency you want and place your order. If your account has no funds, most exchanges allow you to buy crypto instantly using a fiat payment method.

Conclusion

Cryptocurrency trading can be profitable when approached correctly. Success requires diligent research, continuous learning, and staying updated on market trends.

Moreover, having alternative sources of income can ease the pressure of relying solely on trading, especially during the initial stages. With patience, discipline, and the strategies outlined in this guide, you’ll be better equipped to navigate the crypto market confidently.