Forex Trading Guide

- Written By thinkforexbrokers

- Updated:

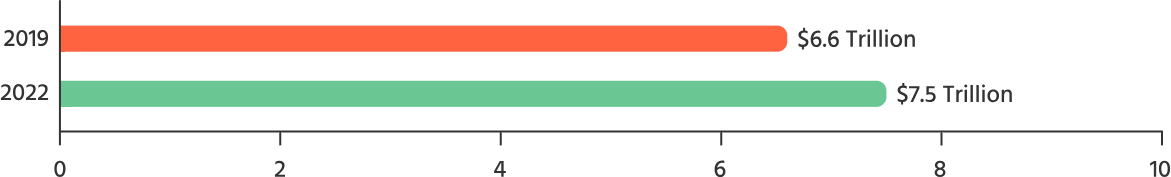

Foreign exchange, often called forex or simply FX, plays a massive role in the global financial system. As of April 2022, daily trading volume in the forex market was estimated at around US $7.5 trillion, making it the largest and most liquid financial market in the world. Millions of traders and investors across the globe participate in it every day.

In this Guide to Forex Trading, we’ll walk you through how the market works, the key concepts you need to understand, and the essential terms every beginner should know before stepping into forex trading.

What is forex?

To begin with, forex (foreign exchange) is the global market where currencies are traded. In this market, one currency is always exchanged for another at an agreed price. Because of this, forex prices are shown as pairs, each pair expressing how much one currency is worth compared to the other.

What is a forex pair?

In forex trading, prices are always quoted in pairs because every trade involves buying one currency while selling another.

For example, EUR/USD is the most widely traded forex pair in the world. In this pair, the euro (EUR) is the base currency, while the US dollar (USD) is the quote, or counter, currency.

A price quote tells you how many units of the quote currency are needed to buy one unit of the base currency. With EUR/USD, it shows how many US dollars are required to purchase one euro, or how many you would receive when selling one euro. Price changes in forex pairs are measured in pips, which usually reflect movement in the fourth decimal place of the quote.

Majors, Crosses and Exotics

When it comes to trading currencies in the global forex market, most of the action revolves around three main types of currency pairs. We’ll break them down in this guide, but first, let’s get a bit of perspective.

According to the United Nations, there are about 180 official currencies being used across 195 countries. That’s a lot, right? Out of those, 37 currencies actually have “dollar” in their name — kind of interesting when you think about it. You’ve got familiar ones like the Australian dollar (AUD), Hong Kong dollar (HKD), Singapore dollar (SGD), Canadian dollar (CAD), and of course, the big one — the US dollar (USD).

In forex, currencies are paired up — that’s the basic setup. You’re always trading one for another. These pairs are grouped into three categories, mostly based on how frequently they’re traded and how much volume they pull in. We’ll go over each type so you know exactly what to expect.

Major pairs

These are the most traded currency pairs in terms of volume and typically contain the US dollar traded against other strong currencies like the EUR, JPY, GBP, CHF, AUD, CAD, and NZD. These eight currencies combine to form seven major currency pairs, namely EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, USD/CAD, and NZD/USD.

Crosses (or Minors)

these forex pairs contain the currencies of highly developed economies but do not include the USD. Popular examples include EUR/JPY, EUR/GBP and EUR/CHF.

Exotics

These forex pairs consist of currencies with lower liquidity and trading volumes and higher interest rate differentials. Many are paired with the USD but not necessarily so. Some examples are USD/TRY, USD/MXN and USD/HKD.

Take a look at the table below, and you’ll notice something pretty interesting. Based on data from the Bank of International Settlements, currencies like the Chinese yuan (CNY) and the Hong Kong dollar (HKD) have been gaining serious traction lately. They’re no longer just regional players — both have become widely traded and are starting to compete with the big names in terms of volume.

One standout detail? The NZD/USD pair was the only major one to see a drop in trading volume during the 2022 triennial survey. Kind of surprising, considering how steady it’s been in past years.

We pulled this data from the BIS triennial survey and put together a table that shows the daily trading volumes of the top currency pairs — plus how those numbers have shifted from 2019 to 2022. It gives a pretty good snapshot of what’s been going on in the market lately.

2019 | 2022 | ||||

Forex pair | Volume | % of Total FX Volume | Volume | % of Total FX Volume | Change in Trading Volume (2019 to 2022) |

All currency pairs | $6,590bn | $7,508bn | |||

EUR/USD | $1,584bn | 24.00% | $1,706bn | 22.70% | 7.70% |

USD/JPY | $871bn | 13.20% | $1,014bn | 13.50% | 16.4% |

GBP/USD | $630bn | 9.60% | $714bn | 9.50% | 13.3% |

AUD/USD | $358bn | 5.40% | $381bn | 5.10% | 6.4% |

USD/CAD | $287bn | 4.40% | $410bn | 5.50% | 42.9% |

USD/CHF | $228bn | 3.40% | $293bn | 3.90% | 28.5% |

NZD/USD | $107bn | 1.60% | $99bn | 1.30% | -7.5% |

Total Majors | $4,065bn | 61.70% | $4,617bn | 61.50% | 13.6% |

USD/CNY | $269bn | 4.10% | $495bn | 6.60% | 84% |

USD/HKD | $233bn | 3.30% | $178bn | 2.40% | -23.6% |

EUR/GBP | $131bn | 2.00% | $154bn | 2.00% | 17.6% |

USD/KRW | $125bn | 1.90% | $128bn | 1.70% | 2.4% |

EUR/JPY | $114bn | 1.70% | $103bn | 1.40% | -9.6% |

USD/INR | $110bn | 1.70% | $118bn | 1.60% | 7.3% |

USD/SGD | $110bn | 1.70% | $170bn | 2.30% | 54.5% |

USD/MXN | $105bn | 1.50% | $103bn | 1.40% | -1.9% |

USD/SEK | $86bn | 1.30% | $93bn | 1.20% | 8.1% |

USD/NOK | $73bn | 1.10% | $81bn | 1.10% | 11% |

EUR/CHF | $73bn | 1.10% | $68bn | 0.90% | -6.8% |

USD/BRL | $66bn | 1.00% | $63bn | 0.80% | -4.5% |

The Forex market

Forex isn’t just big — it’s the biggest market in the world by a long shot. According to the 2022 Triennial Central Bank Survey from the Bank of International Settlements, daily global forex turnover hit a massive $7.5 trillion. That’s up from $6.6 trillion in 2019 — a 14% jump in just three years.

To really put that into perspective, let’s compare it to the stock market. Sure, equities have been around longer and get a lot of attention, but forex has grown at a ridiculous pace. It’s blown past every other financial market out there. In fact, in 2022, the total value of the forex market was estimated at a staggering $2.74 quadrillion. Yep — quadrillion. That’s the kind of scale we’re talking about.

Forex Markets – Who are the players?

Forex is one of the few markets that’s truly global — and completely decentralized. Unlike stock trading, where everything goes through big exchanges like the NYSE or the London Stock Exchange, forex doesn’t work like that. It’s an over-the-counter (OTC) market, which basically means trades happen directly between parties, no middleman exchange required. You could be trading with someone across the globe and not even know it.

This market brings together all sorts of players — from central banks and large corporations to individual traders and everyday people. Not every trade is about chasing profit either. Some of it is practical. For instance, a company might need to convert currency to pay for imported machinery, or hedge against currency fluctuations. Even tourists swapping money at the airport are technically participating in forex (just on a much smaller scale).

That said, a big chunk of the action comes from traders — both pros and individuals — looking to make money off currency movements.

Here’s a quick look at who’s involved in the forex game:

Central banks

Central banks play a massive role in the forex market. They don’t just sit in the background — they actively shape how currencies move. One of the biggest things they control? Interest rates. And those rates matter a lot when it comes to how valuable a currency is. Here’s why: when one country has higher interest rates than another, its currency usually becomes more attractive to investors. People want better returns, and higher rates offer that. So, traders often keep a close eye on the interest rate gap between two currencies — it can be a major driver of price movement. But it doesn’t stop there. Central banks can also step in directly and buy or sell their own currency if they feel it’s getting too weak or too strong. For example, if a currency is dropping too low and pushing up inflation, the central bank might buy that currency to boost demand and help stabilize things.

Investment and commercial banks

Investment and commercial banks are major players in forex. Most of the trading volume comes from the interbank market, where banks trade currencies directly with each other. Sometimes they do it for clients, like large corporations. Other times, they trade with their own money, trying to profit from price swings — that’s called proprietary trading. It’s a fast-moving space and a key part of what keeps the forex market alive.

Money managers and hedge funds

Money managers and hedge funds trade forex all the time — it’s part of managing big, international portfolios. Whether it’s a pension fund, a hedge fund, or an insurance company, they often need to buy foreign currencies to invest overseas or protect their money from currency swings. In many cases, they’ll even hire pros just to handle this side of things.

Non-financial companies

Non-financial companies — like importers and exporters — use the forex market too. When they do business across borders, they often need to exchange currencies. To protect themselves from sudden rate changes, they’ll sometimes use tools like currency swaps to hedge against risk.

Individuals

Individuals — also known as retail traders — use forex brokers to trade currency pairs. Some are in it to speculate on price movements, while others just want to exchange currency on the spot for travel or business.

Here is the proportion of daily forex trading per counterparty, as estimated by the Bank of International Settlements.

Forex Counterparties | Total (US$) | Percentage |

Reporting Dealers | $3,462bn | 46.10% |

Other financial institutions | $3,622bn | 48.20% |

Non-financial customers | $425bn | 5.70% |

Total | $7,508bn | 100% |

A few forex statistics

Here are a few statistics on forex that you might find interesting:

The US dollar (USD) is still king

The US dollar (USD) still wears the crown — it’s involved in nearly 89% of all forex trades. As the world’s reserve currency, it shows up in countless international transactions every single day. Coming in next is the euro (EUR), which makes up about 30.5% of trades. Then you’ve got the Japanese yen (JPY) at 16.7% and the British pound (GBP) at 12.9%. These currencies make up the bulk of the action in the global forex market.

EUR/USD is the most traded pair

EUR/USD takes the top spot as the most traded currency pair, making up about 22.7% of all forex trading volume. After that comes USD/JPY at 13.5%, and then GBP/USD, which accounts for 9.5% of the total.

Individual forex trading

Individual forex trading is still a small fish in a very big pond. Retail traders — meaning non-financial customers — only make up about 6% of the total global forex turnover. So while more individuals are getting into the game, the bulk of the market is still driven by big institutions.

Here are the top 20 most traded currencies on one side of a forex trade:

Currency | Code | Daily Volume | Proportion |

MAJOR CURRENCIES | |||

US dollar | USD | $6,639bn | 88.50% |

Euro | EUR | $2,292 bn | 30.50% |

Japanese yen | JPY | $1,253 bn | 16.70% |

British pound | GBP | $968bn | 12.90% |

Australian dollar | AUD | $479bn | 6.40% |

Canadian dollar | CAD | $466bn | 6.20% |

Swiss franc | CHF | $390bn | 5.20% |

New Zealand dollar | NZD | $125bn | 1.70% |

OTHERS | |||

Chinese yuan | CNY | $526bn | 7.00% |

Hong Kong dollar | HKD | $194bn | 2.60% |

Swedish krona | SEK | $168bn | 2.20% |

Korean won | KRW | $142bn | 1.90% |

Singapore dollar | SGD | $182bn | 2.40% |

Norwegian krone | NOK | $125bn | 1.70% |

Mexican peso | MXN | $114bn | 1.50% |

Indian rupee | INR | $122bn | 1.60% |

Russian ruble | RUB | $14bn | 0.00% |

South African rand | ZAR | $73bn | 1.00% |

Turkish lira | TRY | $27bn | 0.00% |

Brazilian real | BRL | $66bn | 1.00% |

Total | $7,506bn | 100.00% | |

Forex – a 24 hours per day market, 5 days per week

The forex market is truly global — and it pretty much never sleeps. Except for weekends, it runs 24 hours a day, five days a week.

The main trading hubs? London, New York, Sydney, and Tokyo. And since everyone’s in different time zones, the market is always open somewhere on a weekday. For traders in Europe, things usually kick off around 10 PM GMT on Sunday night (when Asia starts trading) and wind down around 10 PM GMT on Friday (when the U.S. session closes).

Because Australia and Japan are in similar time zones, they’re grouped together into what’s called the Asian session. It’s a bit unique — markets open gradually across the region, starting with New Zealand, then Tokyo, followed by Sydney, Hong Kong, and Singapore.

All of this forms the well-known three-session structure in forex trading. Here’s how the global sessions break down:

Session | Main hub | Duration of Session |

European session | London | 8 am GMT / 5 pm GMT |

North American session | New York | 1 pm GMT / 10 pm GMT |

Asian session | Sydney / Tokyo | 12 am GMT / 9 am GMT |

Watching the volatility during the session overlaps

If you look at the trading hours for the three sessions, you’ll notice there are times when they overlap — like when London and New York are both open. These overlap windows tend to be the busiest. With more traders in the market at the same time, trading volume picks up, and so does volatility. In other words, things can move fast.

As the Asian session winds down and the European session kicks in, there’s a short overlap—roughly around 7 AM to 8 AM GMT. It’s not the busiest window, but it does mark the transition where trading starts to pick up as Europe comes online.

By the time the European afternoon rolls around, US traders are just settling in — coffee in hand, markets opening. This creates a solid 4-hour overlap between 12 PM and 4 PM GMT, when both the US and European sessions are in full swing. It’s one of the most active — and often most volatile — times of the trading day.

There’s also a quieter stretch in the trading day that’s worth keeping in mind. As the US session winds down around 8–9 PM GMT, there’s usually a dip in activity. That’s because it takes a bit of time before traders in Asia really get going.

There’s a decent time gap — about five hours — between the West Coast of North America and when trading starts in New Zealand, and even longer before Tokyo fully kicks in.

If you look at the volume chart for EUR/USD, the most traded forex pair, you’ll notice clear spikes in volume during the session overlaps — especially during the European–US overlap in the afternoon. You’ll also see a noticeable dip as the US session hands over to Asia.

Forex speculation

Now let’s dive into the part most people are curious about — how to actually trade forex. In other words, how to speculate on currency movements and (hopefully) make a profit.

A simple forex trade

Let’s say a trader buys EUR/USD when it’s trading at 1.2000. That means they’re using $1.20 to buy €1. Now, if the price later climbs to 1.2500 and they decide to sell, they’d get $1.25 for that same €1. That’s a profit of 5 cents — just from that move.

This is what speculating in forex is all about. Traders are trying to predict whether a currency pair will go up or down in value. You can either buy (that’s called going long) or sell (going short), depending on which way you think the market will move.

So, if you think the euro is going to get stronger compared to the dollar, you’d buy EUR/USD. But if you believe the euro’s going to lose value against the dollar, then you’d sell EUR/USD instead.

A forex quote

It shows that it costs $1.18196 to buy €1 — in other words, you’d need 1.18196 US dollars to get 1 euro. But if you look closely, you’ll notice there are actually two prices listed. That’s because a forex quote always comes as a pair of prices — one for buying, and one for selling.

What is the spread?

The two numbers you see in a forex quote are called the bid price and the ask price. The bid is the price at which you can buy euros, and the ask is the price at which you can sell them.

The bid price is always the higher price, in this instance 1.18196.

The ask price is always the lower price, here 1.18185. This is also sometimes referred to as the “offer” price.

The difference between the bid and ask prices is called the spread. This tiny gap is how forex brokers or dealers make their money — it’s basically their fee for handling the trade.

In this quote, the spread is 0.00011, which equals 1.1 pips. But what exactly does that mean?

What is a pip?

Forex prices are measured in something called pips, short for “percentage in point.” In most currency pairs, a pip is the fourth decimal place — so if EUR/USD moves from 1.1853 to 1.1857, that’s a 4-pip increase.

Some brokers quote prices to a fifth decimal place, which is just one-tenth of a pip. They do this because their spreads can be variable. For example, if the price moves from 1.18376 to 1.18293, that’s a drop of 8.3 pips.

There’s one big exception: yen pairs. When you’re trading something like USD/JPY, a pip is the second decimal place, not the fourth. So if the price goes from 110.52 to 110.57, that’s a 5-pip move.

The use of leverage

Compared to other markets, forex doesn’t move all that wildly. In the stock or crypto world, seeing prices jump or drop 10% in a day isn’t unusual at all. But in forex? A 1% or 2% move in a single day is considered massive. Most of the time, currency pairs barely shift more than 0.5% daily.

Just to give you an idea — if EUR/USD suddenly moved 10% in one day, it would probably signal some global meltdown. That kind of move would shake the entire financial system.

So, if forex moves so little, how do traders actually make money? The answer is leverage — and that’s where things get interesting.

Lots

In forex, trade sizes are measured in “lots.” On a standard account, 1 lot equals 100,000 units of the base currency.

So, if you buy 1 lot of EUR/USD at 1.1850, you’re actually trading with $118,500. In this case, a 1-pip move — which is the fourth decimal place — would equal a $10 change in your position.

Let’s say the price goes up by 22 pips, and you close the trade at 1.1872. Your position would now be worth $118,720, giving you a profit of $220 on that trade.

Margin & Leverage

Without leverage, most traders wouldn’t have enough capital to control positions as large as 100,000 units of currency. That’s where leverage comes in — it gives you access to much bigger trades with a much smaller deposit.

How much leverage you can use depends on where you’re trading. In stricter regions like Europe, it’s usually capped at around 1:30. But in other places — like Mauritius, Vanuatu, or the Bahamas — leverage can go much higher, sometimes into the hundreds.

For example, with 1:30 leverage, you’d only need to put up about 3.33% of the trade’s total value. So to open a $100,000 position, you’d just need $3,300 in your account.

The risk of trading forex on margin

That said, trading larger positions also means taking on a lot more risk. As mentioned earlier, when you’re trading 1 lot (100,000 units), every 1-pip move in EUR/USD is worth $10.

Even though forex pairs usually don’t move much in percentage terms, with leverage in play, a 40 or 50 pip swing can happen fast — sometimes in just a few minutes. And if you’re not using proper risk management, like setting a stop-loss, it doesn’t take much to wipe out your trading account.

Different forms of forex trading

There are a few different ways you can trade forex, and it’s important to understand the differences. You can trade what’s called the spot market, where you’re actually buying and selling the currency itself. Or, you can trade derivatives, which are contracts that let you speculate on price movements without owning the actual currency.

Each method has its own features and quirks — and we’ll break them down for you next.

Spot forex

Spot forex is the main market where most of the actual currency buying and selling happens. It’s heavily dominated by big banks, which is why you’ll often hear it called the “interbank market.” In this setup, institutional traders usually deal directly with one another. Trades in the spot market typically follow a T+2 settlement — that just means if a bank buys euros on a Monday, the funds are usually exchanged on Wednesday.

Individual traders (the retail trader)

Individual traders, also known as retail traders, get access to the forex market through brokers. These brokers act as the middlemen between regular traders and the big institutions, like major banks. The banks provide the liquidity, and the brokers pass it along to their clients. Brokers also allow retail traders to use margin, which means they can trade with much more money than they actually have in their account. But while margin can boost potential profits, it also increases risk — a lot. Without proper risk management, losses can pile up quickly.

Forex Forwards and Futures

Forex forwards and futures are both ways to trade currencies at a set price on a future date — but they work a bit differently. A forward is a private deal between two parties. They agree to exchange a specific amount of currency at a fixed rate on a future date. These contracts are flexible but aren’t traded on any exchange — it’s all done off the books, so to speak. Futures, on the other hand, are standardized contracts traded on public exchanges. The terms are fixed, and they’re regulated, which adds a layer of transparency. The main difference? Forwards are private and customizable, while futures are public and standardized.

Forex Options

Forex options give you the right — but not the obligation — to buy or sell a currency at a set price on a specific date in the future. They’re a lot like futures, but with one key difference: with futures, you’re required to go through with the trade. With options, you’re not. If the market moves in your favor, you can choose to exercise the option. If not, you can just let it expire — and the only thing you lose is the premium you paid for the option in the first place. This setup helps limit risk, which is why some traders use options as part of a broader strategy.

Forex Swaps

Forex swaps are agreements between two parties to exchange interest payments in different currencies over a set period of time. These deals usually happen between large companies or institutions and are often used to manage long-term currency risk. Let’s say a U.S. company needs euros for a project in Europe. Instead of borrowing euros directly (which might be expensive), it could borrow in U.S. dollars and then use a currency swap with a European company that needs dollars. They’d exchange both interest and principal payments, helping each other get better loan terms in their local markets. Swaps are more of a long-term strategy, mainly used for hedging or getting more favorable interest rates.

This table lays out the level and proportion of daily volumes of the various forex trading instruments.

FX Instruments | Total (US$) | Percentage of Total Forex Volume |

Spot | $2,107bn | 28.10% |

Outright forwards | $1,163bn | 15.50% |

FX Swaps | $3,810bn | 50.70% |

Currency Swaps | $124bn | 1.70% |

FX Options | $304bn | 4.10% |

Total market | $7,508bn | 100.00% |

How to be a forex trader?

Now let’s take you through the steps of becoming a forex trader:

Learn your trade

Learn your trade. Before diving into forex trading, take the time to really understand what you’re getting into. Get familiar with how things like spreads, leverage, and volatility work — and how the forex market moves in general. Start by reading trusted online resources, checking out well-reviewed books, or exploring the educational content offered by brokers. All of this builds a strong foundation to grow your trading skills. And don’t skip over risk management. Learn how to use tools like stop-loss orders and make sure you understand how to size your positions properly — it can make all the difference between staying in the game and wiping out early.

Set up an account with a forex broker

Set up an account with a forex broker. But before you jump in, take some time to find the right fit for you. Every broker is different — some offer lower fees, others focus on trading tools or research, and some are known for great customer support. Think about what matters most to you as a trader, whether it’s tight spreads, helpful educational content, or a user-friendly platform. Sites like BestBrokers.com can help you compare your options and make a smart choice.

Develop a trading strategy

Develop a trading strategy. Going in without a plan is a fast track to losing money. Take time to build a clear strategy — know what you’re trading, why you’re trading it, and when you’ll get in or out. Also, get familiar with your trading platform. A small mistake like clicking the wrong button can cost real money, so practice before going live.

Self-reflection

Spot forex is the main market where most of the actual currency buying and selling happens. It’s heavily dominated by big banks, which is why you’ll often hear it called the “interbank market.” In this setup, institutional traders usually deal directly with one another. Trades in the spot market typically follow a T+2 settlement — that just means if a bank buys euros on a Monday, the funds are usually exchanged on Wednesday.

Stay on top of current events

Stay on top of current events. Markets don’t stay still — they react to news, data, and global events. The more you understand what’s driving the market, the better you can adjust your positions when things shift.

What is a forex broker?

You could take your dollars or euros to a local currency exchange and trade them for another currency. But traditional exchange bureaus often have poor rates, high fees, limited hours, and no option to use leverage or aim for higher returns.

Thankfully, there’s a simpler way for individuals to access the forex market and try to earn a profit. But they can’t do it alone. Traders need a middleman to link them to the market. This middleman is known as a forex trading provider, or simply a forex broker.

A broker gives the trader access to a trading platform and the forex market. The trader can then speculate on currency movements. Brokers may also offer leverage, which increases exposure and profit potential. In return, they charge a fee—either through spreads, commissions, or both.

Different Styles of Forex trading

There are many different ways in which traders can dip their toes into the forex market. Some look to trade with an extremely short-term outlook, whilst others like to play the long game.

- Scalping: Think of scalpers as trying to capture tiny profits from numerous small price fluctuations throughout the day, like repeatedly skimming small amounts off the top.

- Day Trading: Day traders aim to profit from intraday price movements, closing all their positions before the end of the trading day to avoid overnight risks, similar to completing a full workday of trading activity.

- Swing Trading: Swing traders look to capture ‘swings’ in price over a few days, riding short-term trends and often holding positions overnight, like surfing waves in the market.

- Trend Chasing: Trend followers identify established trends and aim to ride them for a more extended period, capitalizing on momentum, similar to following a prevailing current.

- Position Trading: Position traders take a long-term view, often aligning their trades with fundamental economic trends and holding positions for months or even years, like investing in a long-term growth stock.

Let’s take a look at the various methods you could employ.

Trading style | How often do you trade | Length of time holding a position | Idea generation |

Scalping | Many per day – Positions opened and closed very quickly | A few seconds to minutes | Short-Term Technical Analysis |

Day trading | Several per day | Several minutes to hours | Data / Newsflow / Technical Analysis |

Swing trading | Several per week | A few days | Technical Analysis |

Trend chasing | Several per month | A few weeks | Technical analysis |

Position trading | A few per year | Months, maybe years | Fundamentals |

What moves the forex markets?

Forex markets are constantly shifting, influenced by a wide range of factors. A key driver is the outlook for one currency compared to another, which affects how currency pairs move. Knowing what causes these price changes — and being able to anticipate them — can make or break your trading success.

Below are some of the main forces that drive the forex market:

The outlook for interest rates

Interest rate outlooks play a big role in currency movements. Central banks raise or cut rates to guide their economies, and traders watch closely for clues about what’s coming next. Higher rates tend to attract foreign investment, which boosts demand for that currency. Bond yields often reflect these expectations, and forex prices usually follow the same direction as bond market sentiment.

Newsflow

Newsflow can have a major impact on currency values. Political events like elections, economic reports such as inflation or job data, and even natural disasters all influence how a currency is valued. These developments affect investor confidence and can quickly shift the direction of forex markets.

Sentiment

Sentiment plays a key role in forex price movements. Market momentum and overall mood can drive currencies up or down, sometimes regardless of the data. Traders rely on tools like fundamental and technical analysis to try to anticipate these shifts and position themselves accordingly.

Pros and Cons of forex trading

Before diving into forex trading, there are a few things worth thinking about. It’s easy to see why so many retail traders are drawn to the market, but it’s not without its risks.

Below are some of the main pros and cons of trading forex:

- Key Pros

- Trade forex 24 hours per day, five days a week – markets are open every hour, Monday to Friday. This allows traders to trade markets when they want, day or night.

- Go long or short – when trading forex, you can speculate on the price moving higher or lower. Whichever way you think the market direction is headed, you can profit. It’s your call.

- Lower fees – Trading in equities, bonds and funds (such as ETFs and mutual funds) will often incur extra fees and commissions, possibly even on top of the spreads charged. If you do your research and pick the right broker, trading forex can be an asset class that keeps your trading costs much lower than other assets. Commissions and extra fees are not typically a feature of trading forex (unless you choose a zero-spread account that specifically does this to reduce costs even further).

- Forex markets are highly liquid – the huge number of market participants enables tight spreads and reduced gapping. Tight spreads on markets help keep the costs of trading low. With forex, you are trading in a truly global market, meaning that with so many participants, this reduces the potential for slippage and gaps when orders are being filled.

- Trade forex on margin – gives you the exposure to make bigger profits. Brokers tend to offer higher margin levels on forex instruments. With the high levels of liquidity and fast-moving markets, trading forex on margin enables traders to generate returns faster.

- Key Cons

- Margin trading can be just as risky as it is beneficial. Margin trading in combination with highly volatile markets means that high leverage can lead to bigger and quicker losses.

- Overnight financing charges – arguably the hidden costs of forex trading. Traders are often (but not always) charged just for holding positions open overnight. This is in contrast to investing in equities or bonds which have no financing charges and periodically pay a yield (either dividends or interest) for holding the asset.

- The disadvantage of being a small fish in a big pond – forex markets are dominated by the big banks who have access to state-of-the-art technology, research and can influence prices with their positions. Forex retail traders can feel like they are being buffeted around by the bigger players in the game. However, just because the banks are bigger, it does not mean they are always right.

Conclusion

Forex trading has become a very popular way to invest. With the use of margin, skilled traders can turn it into anything from a solid side income to a full-time career.

In this guide, we’ve covered what forex is, how the market works, and how to get started. Most importantly, we’ve stressed the value of doing your research and approaching trading with a clear, informed mindset.

Wishing you the best of luck on your forex trading journey!