Gold Trading Guide

- Written By thinkforexbrokers

- Updated:

Gold has been a central element in human trade and commerce for over 3,000 years, dating back to the rise of ancient civilizations in the Middle East, making it the oldest recognized form of money still acknowledged today. Historically, gold has been seen as the quintessential “safe haven” asset, trusted as a store of value during times of war, natural disasters, and the rise and fall of empires across different eras.

Gold’s value fluctuates constantly, whether held physically as jewelry or as part of an investment portfolio at a brokerage. Some investors skillfully exploit these price movements to generate profits through speculation, while others purchase gold as a hedge. A hedge allows investors to offset potential losses in other assets, such as stocks, since gold often increases in value during periods of stock market turmoil.

Despite its long-standing reputation for preserving wealth, investor interest in gold has varied over time. For instance, between the early 1980s and the early 2000s, demand for the precious metal was relatively low due to strong economic growth and bullish stock markets. During that period, gold prices mostly ranged between $300 and $500 per ounce.

Investors’ interest in the metal rose slowly through the 2000s and skyrocketed in 2008 during the Great Financial Crisis. The price of Gold initially peaked just above $1,900 per ounce in late 2011 and then reached a record-high level of $2,074.88 in August 2020.

As of April 24, 2024, the price of gold has reached a new high, being evaluated at around $3,330 per ounce.

In this guide, we will examine the key factors influencing Gold’s valuation, explore the most popular methods for trading the commodity, and provide several practical Gold trading strategies.

Gold is often considered one of the most complex financial assets to assess. On one hand, it shares characteristics with traditional currencies such as the US Dollar or British Pound, being durable, portable, globally uniform, and widely accepted. However, unlike conventional currencies, Gold is not supported by an underlying economy of consumers, businesses, or infrastructure.

On the other hand, Gold also resembles other commodities, such as Oil or Wheat, since it is mined from the earth and standardized in terms of its physical properties. Yet, unlike most commodities, Gold’s price frequently fluctuates independently of industrial supply and demand. In reality, only around 10% of global Gold is used in industrial applications, such as electronics, due to its conductivity and anti-corrosive characteristics, while the remaining 90% is primarily used in jewelry or held for investment purposes.

Gold as a “hedge”

Many investors focus on Gold due to its established role as a “hedge.” This implies that holding positions in Gold can help mitigate losses in other asset classes within an investor’s portfolio. Gold’s price is often inversely correlated with certain other assets: when those assets fall in value, Gold generally rises, and vice versa.

A key example of this negative correlation is with fiat currencies, particularly the US Dollar. This relationship will be explored in greater detail in the next section of the guide.

Gold can also act as a safeguard against inflation. Central banks can expand the money supply to stimulate the economy when needed. Since the total supply of Gold is limited, such increases in money supply tend to push Gold prices higher over time.

It is also important to note that some traders engage with Gold purely for speculative purposes. They trade the commodity based on anticipated market movements rather than for portfolio protection. For instance, when Gold nearly doubled during the late 2000s financial crisis, this rise was driven not only by investors seeking hedges but also by traders who identified the trend early and sought to profit from heightened risk aversion in the market.

What is a Gold reserve?

The quantity of physical Gold held by a government or a national central bank to support the domestic currency is referred to as that country’s gold reserve. During periods when the gold standard was in effect, a nation’s gold reserve was used to honor obligations to noteholders, depositors, or trading partners. Typically, the gold reserve forms a portion of a country’s broader Foreign Exchange reserves, which are designed to stabilize its balance of payments, influence the foreign exchange rate of the local currency, and maintain confidence in the domestic financial system.

Data from the World Gold Council shows that central banks worldwide acquired 333 tonnes of gold in Q4 to bring the net annual total for 2024 to 1,045 tonnes.

Now let us examine the 10 countries with the largest Gold reserves in the world. As the International Monetary Fund (IMF) is not a sovereign nation, it is excluded from the table below.

Since 2011, the IMF’s Gold holdings have remained unchanged at 2,815 tonnes, which would place it third if it were included in the ranking.

Country | Gold Reserve in Tonnes | % of Foreign Exchange Reserve |

United States | 8133.5 | 74.97% |

Germany | 3351.53 | 74.39% |

Italy | 2451.8 | 70.79% |

France | 2436.97 | 72.27% |

Russian Federation | 2335.9 | 29.47% |

China | 2279.6 | 5.53% |

Switzerland | 1,039.94 | 9.59% |

Japan | 845.97 | 5.77% |

India | 876.18 | 11.35% |

Netherlands | 612.5 | 64.93% |

While not on the list of the biggest gold reserves worldwide, the National Bank of Poland purchased the highest amount of gold in 2024, acquiring 90 tonnes and bringing its gold reserve total for 2024 to 448.23 tonnes.

The relation between Gold, interest rates and the US Dollar

History has shown that one of the primary factors influencing the price of Gold is the level of real interest rates, which are interest rates adjusted for inflation. During periods of high real interest rates, traditional investment options such as cash deposits or government bonds tend to provide attractive returns.

Conversely, in periods of low real interest rates, returns on cash or government bonds are often minimal or even negative. This situation encourages investors to look for alternative ways to preserve their wealth, with Gold frequently being their preferred choice.

When yields on US government bonds decline—whether due to falling inflation expectations or disappointing macroeconomic data—the price of Gold generally rises. Because Gold does not generate interest, lower interest rates and falling bond yields reduce the opportunity cost of holding the metal. Whenever global bond yields drop significantly, sometimes even below zero, investors often buy Gold to hedge against diminishing returns.

On the other hand, if global bond yields increase because of improvements in economic, political, or health conditions, the opportunity cost of holding Gold rises as well, making it less appealing for investors.

Another key relationship exists between Gold and the US Dollar. When the US Dollar weakens, especially against currencies like the Chinese Yuan or Japanese Yen, Gold prices typically increase due to heightened demand. A weaker US Dollar makes Gold more attractive to international investors holding other currencies, while a stronger US Dollar tends to reduce Gold’s appeal.

It is also important to note that most online brokerages now provide Gold Contracts for Difference (CFDs), which are typically denominated in USD, EUR, GBP, JPY, and other major currencies. These brokerages automatically convert the USD-based Gold price into EUR, GBP, or JPY in real time using current spot exchange rates such as EUR/USD, GBP/USD, or USD/JPY.

By buying Gold CFDs in a weaker currency or selling in a stronger currency, traders can maximize returns. For example, if you expect the Euro to depreciate against other major currencies over the next week, purchasing Gold in Euros (trading XAU/EUR) may generate a higher percentage return than buying Gold in US Dollars (trading XAU/USD). In this scenario, if the EUR/USD rate falls while Gold prices rise, trading XAU/EUR would yield a larger profit than trading XAU/USD.

How can you trade Gold?

As a trader, you have a number of options to speculate on the price of Gold. Those include trading Gold stocks, Gold ETFs, Gold Futures, Gold Options, Gold CFDs as well as physical Gold (bullion bars or coins).

Option 1: Trading Gold Stocks

One way to gain exposure to Gold market movements is by holding a portfolio of Stocks that generally track the price of Gold. These are typically shares of Gold mining and exploration companies. Even if the companies’ gold reserves have not yet been extracted, the value of their shares often moves in tandem with fluctuations in the price of Gold.

However, it is important to note that the correlation between Gold-related Stocks and the metal itself can vary. Share prices can be influenced by additional factors beyond the price of Gold, including broader stock market volatility and company-specific developments.

Some of the prominent Gold exploration and mining Stocks that investors may consider include:

Gold Stock | Information | Established in | Listed at |

Barrick Gold | The biggest gold mining company worldwide, based in Toronto. Initially, it was established as an oil and gas company. | 1983 | New York Stock Exchange, Toronto Stock Exchange, and London Stock Exchange |

Newmont Mining | Gold mining company, headquartered in Colorado, US. It is the only gold company included in the S&P 500 Index. | 1916 | New York Stock Exchange |

Newcrest Mining | A leading gold mining company in Australia. Initially, it was a subsidiary of Newmont Mining Co. | 1966 | Australian Securities Exchange in Sydney |

AngloGold Ashanti | Gold miner and explorer, headquartered in Johannesburg. The company operates 17 mines located in 9 countries. | 2004 | Johannesburg Stock Exchange, New York Stock Exchange, Australian Securities Exchange, London Stock Exchange, Euronext Paris, Ghana Stock Exchange |

Polyus Gold | A gold mining company, based in Moscow. Polyus Gold is in fact the biggest gold miner in the Russian Federation. | 2006 | London Stock Exchange and Moscow Exchange |

Option 2: Trading Gold ETFs

Exchange-Traded Funds (ETFs) are collections of securities, typically company shares, that are traded on stock exchanges just like individual stocks. The composition of an ETF varies, with the number of shares per company depending on the overall allocation of all the companies included in the fund.

Gold ETFs provide an efficient way to gain exposure to the price of Gold without having to pay storage fees for physical gold or assume risks related to keeping it at home. Furthermore, ETFs are priced in real time, which makes it easy for investors to monitor the value of their holdings continuously.

The five largest Gold ETFs, ranked by total assets under management, include:

- SPDR Gold Trust

- iShares Gold Trust

- SPDR Gold MiniShares Trust

- ETFS Physical Swiss Gold Shares

- GraniteShares Gold Trust.

Option 3: Trading Gold Futures

Gold Futures are derivative instruments that allow traders to speculate on the future price movements of the commodity through the purchase of exchange-traded contracts. These contracts are typically listed and traded on exchanges such as the Chicago Mercantile Exchange (CME), the Tokyo Commodity Exchange, or the London Metal Exchange (LME).

When entering a Gold futures contract, traders can either accept the contract’s specified delivery date or opt for a “rollover,” which extends the contract to a later delivery date without taking physical delivery of the commodity.

Next, let us examine the contract specifications for Gold Futures, E-Mini Gold Futures, and Micro Gold Futures, all of which are traded on the COMEX division of the Chicago Mercantile Exchange.

Gold Futures | E-Mini Gold Futures | Micro Gold Futures | |

Contract Unit | 100 troy ounces | 50 troy ounces | 10 troy ounces |

Price Quote in | US Dollars and Cents per troy ounce | US Dollars and Cents per troy ounce | US Dollars and Cents per troy ounce |

Minimal Price Fluctuation | $0.10 per troy ounce | $0.25 per troy ounce | $0.10 per troy ounce |

Listed Contracts | Delivery is usually during the current calendar month; the next two calendar months; any February, April, August, and October falling within 23 months | Delivery is usually in any February, April, June, August, October, and December falling within 24 months for which a 100 Troy Ounce Gold Futures contract is listed | Month-to-month contracts listed for any February, April, June, August, October and December in the nearest 24 months |

Settlement Method | Deliverable | Financially Settled | Deliverable |

Option 4: Trading Gold Options

A Gold options contract is an agreement between two parties that allows for a potential transaction involving a specific quantity of Gold. As a derivative instrument, the underlying asset of a Gold options contract can be either physical Gold or futures on physical Gold. Each contract includes preset details such as quantity, delivery date, and strike price. These contracts are actively traded on derivatives exchanges worldwide. In the United States, for example, Gold options are listed on the COMEX exchange.

There are two primary types of Gold options: call options and put options. Gold call options give the holder the right, but not the obligation, to purchase a set amount of Gold at the predetermined strike price until the option expires. These options are typically more valuable when Gold is in an uptrend, as the holder secures the ability to buy at a lower price. Buyers of Gold call options hold the right to purchase the commodity, while sellers are obligated to sell the Gold at the agreed strike price if the buyer exercises the option before expiration.

Gold put options, on the other hand, provide the holder with the right, but not the obligation, to sell a defined amount of Gold at the predetermined strike price until expiration. Put options generally increase in value when Gold is in a downtrend because the holder can sell at a higher locked-in price. Buyers of Gold put options have the right to sell the commodity, whereas sellers are required to purchase Gold at the preset price from the option holder if exercised.

In case neither the holder of the call option nor the holder of the put option exercises their rights, the options contract will expire as worthless.

Option holders will typically choose to exercise their Gold options only when it is financially advantageous under current market conditions. If the market price of Gold is significantly higher than the option’s strike price, exercising the option allows the holder to profit by selling the Gold at the prevailing market price. This way, the investor can realize a gain over and above the strike price.

Conversely, if Gold is trading at or close to the option’s strike price, exercising the option may result in a breakeven scenario or even a loss when the initial cost of purchasing the option is taken into account. In such cases, the option holder may prefer to let the option expire unexercised to avoid unnecessary losses.

Option 5: Trading Gold CFDs

Gold Contracts for Difference (CFDs) are leveraged financial products that require traders to deposit only a small fraction of the total trade value, commonly referred to as the margin requirement.

These derivative instruments enable investors to speculate on the price movement of Gold without the need to actually own the underlying asset, whether it be physical Gold, Gold shares, Gold ETFs, Gold Futures, or Gold Options.

The value of a Gold CFD is determined by the difference between the price of Gold at the time of opening the position and the current market price. This difference may be calculated based on Gold’s spot price, Futures contracts, ETFs, or shares of Gold mining companies.

One major benefit of trading Gold CFDs is the absence of storage costs or conventional trading commissions. The primary cost involved is the bid-ask spread, which varies depending on the chosen online brokerage.

On the other hand, trading Gold CFDs carries a high risk due to the use of leverage, which can lead to rapid and substantial losses. Therefore, it is strongly advised to acquire a thorough understanding of these instruments before trading with real funds. A practical first step is to open a demo account with a reputable broker, allowing you to test both the platform features and various Gold trading strategies using virtual funds. Once you are confident to trade with real money on a live account, it is essential to carefully monitor risk exposure and make full use of all available tools to manage the inherent risks of CFD trading.

Note that Gold CFD trading has been prohibited in the United States since the passing of the Dodd-Frank Act in 2011. On the other hand, US residents are able to trade gold physically, via derivatives such as Futures and Options, as well as to trade Gold mining shares.

Option 6: Operating with physical Gold

Finally, another way to invest in Gold is by purchasing and holding physical Gold in the form of bullion bars or coins. As a bullion investor, you can choose to store your Gold safely at home in a secure safe, or pay an additional fee to keep it in a professional, high-security storage facility. Several well-known online Gold bullion dealers you may consider include:

GoldBroker.com – vaults located in Zurich (Switzerland), Singapore Freeport, New York (US) and Toronto (Canada); storage fees from 0.95%;

BullionVault.com – bank-level vault security; 0.50% fee on the first transaction of $75,000 or currency equivalent.

Other alternatives for trading Gold include spread betting and trading Gold at its spot price in a specific currency.

If you live in the United Kingdom or Ireland, spread betting represents another widely used method to gain exposure to Gold. By opening a spread betting account with reputable online brokers such as CMC Markets, you can speculate on the price fluctuations of Gold without actually owning the physical metal. When you spread bet on Gold, you may also enjoy benefits such as:

No capital gains tax on profits from spread betting

No trading commissions charged

No obligation to pay stamp duty, as you simply speculate on price movement of Gold without owning the real asset.

Trading Gold in pairs against a specific currency, such as the US Dollar or the Euro, closely resembles Forex trading. Rather than trading two currencies, the pair consists of the precious metal and its spot price in the chosen currency. The spot price indicates the current price at which Gold can be bought or sold for immediate settlement. Among the most actively traded metal-currency pairs are Gold/US Dollar (XAU/USD), Gold/Euro (XAU/EUR), Silver/US Dollar (XAG/USD), Silver/Euro (XAG/EUR), and others.

Gold trading hours

Gold trading, unlike many other daytime market segments, is accessible to traders 24 hours a day. However, it is important to note that certain derivatives markets, such as Gold Futures, have defined trading hours depending on the exchange where they are listed. For example, Gold Futures on CME’s COMEX trade from Sunday through Friday, from 5:00 pm to 4:00 pm Central Time.

Is Gold highly liquid and can it be traded in a short term?

Gold, along with other precious metals such as silver, platinum, and palladium, is a highly liquid asset and is widely regarded as one of the most inflation-resistant physical assets. Its price tends to move at a relatively steady pace over time, meaning that sudden spikes or drops are less common compared to other assets like cryptocurrencies. Despite being considered a lower-risk speculative trading instrument, careful forecasting and accurate timing can make Gold a profitable asset for short-term trading.

However, it is worth noting that some day traders may refrain from taking positions in Gold due to its relatively limited volatility in the short term.

Are there any cons of trading Gold? Are Gold coins more valuable than Gold bullion?

Similar to other commodities, Gold also comes with certain disadvantages. Trading or storing some forms of Gold can be expensive, particularly when dealing with physical Gold such as coins and bullion bars.

Some traders also view Gold’s historically volatile price as a potential drawback.

When considering physical Gold, coins are often valued slightly higher than bullion bars due to the additional minting costs associated with producing coins. Nevertheless, many Gold traders choose to hold both coins and bullion, as they may differ in quality. Over time, Gold coins can also acquire artistic and sentimental value.

Let us now provide a concise summary of the main advantages and disadvantages of Gold trading.

- Gold pros

- Can be used as a hedge against economic and political turmoil, natural disasters

- Can be used as a hedge against inflation

- Can hold its value in time

- A liquid investment regardless of its restricted supply

- Protects investors’ wealth and diversifies investors’ portfolio

- Not correlated to the stock market and some other asset classes

- Gold cons

- It is not a passive investment

- Trading is associated with currency risk due to a tight relation with the US Dollar

- It is not an yielding instrument (pays no interest)

- Gold ETFs can be associated with higher trading fees

- Historically, it has considerably underperformed other market segments such as stocks and bonds over a longer period of time

Trading Gold with IC Markets, a leading CFD provider

IC Markets, one of the leaders in online Forex and CFD trading services worldwide, offers some of the best conditions to trade Gold via CFDs. If you select this brokerage, you will be granted access to:

- deep interbank liquidity and raw pricing in Gold on the Raw Spread Account, with spreads as tight as 0.0 pips;

- leverage ratios of up to 1:500;

- exceptional order execution with low latency and no dealing desk intervention;

- no restrictions on trade sizes – micro lots trading is allowed for tighter risk management;

- sound environment for expert advisor development and backtesting, allowing for automation of your Gold CFD trades;

- no restrictions on trade orders – a condition that would best suit trading styles such as scalping. You will be able to place your Stop Loss and Take Profit orders at the closest pip distance possible from the current market price.

Opening a live account with IC Markets is a quite fast and effortless process, including several steps:

Providing Contact Details – country of residence, first and last name, email address and telephone number;

Providing Personal Details – date of birth and address;

Choosing an account type – individual, joint or corporate;

Configuring the trading account – choosing a trading platform, an account type (Standard or Raw Spread) and a base account currency;

Providing information about your trading experience and selecting a security question;

Declaration that you have read and agree with all the legal documentation of IC Markets, including Terms and Conditions, Order Execution Policy, Privacy Policy and Risk Disclosure Notice;

Providing proof of ID (Passport, or National ID card, or Driver’s License) and proof of residency (utility bill, or bank account statement), which IC Markets will have to verify;

Once you have filled the profile form and uploaded your identifying documentation, you will have to wait until the brokerage verifies your live account. That procedure takes one business day;

Once the review is complete, you can fund your account and start trading Gold CFDs.

You will also be able to test Gold CFD trading strategies risk-free on IC Markets’ Demo Account by using virtual funds.

Next, we shall provide several Gold trading strategies, including ones based on technical studies. Let us begin with one of the most popular trading approaches.

The Buy-and-Hold strategy

Owing to historical factors that make Gold a sought-after investment, some traders prefer to purchase a certain amount of the metal and hold it for an extended period. When following this strategy, identifying the optimal market timing is crucial, though it may not always present itself immediately.

To spot a favorable buying opportunity, examine a larger chart timeframe, such as the weekly chart, and apply the Bollinger Bands technical indicator. Opening a long (buy) position in Gold when the price is near the lower boundary of the Bollinger Band range can often represent a well-timed entry point for a trade.

Paying attention to the Gold/Silver ratio

Another strategy that long-term traders may consider involves monitoring the gold/silver ratio. The rationale behind this approach is that, historically, both precious metals have served as stores of value while also having practical commercial applications.

The Gold/Silver ratio represents the relative relationship between the spot prices of gold and silver, essentially indicating how many ounces of silver can be obtained in exchange for a single ounce of gold.

Traders often formulate strategies by analyzing which metal is relatively cheaper. A low ratio may suggest that Gold is undervalued or that Silver is overvalued, and the opposite holds true for a high ratio.

For instance, if you hold 1 ounce of Gold and the ratio climbs to historically high levels, such as 150, you could exchange that 1 ounce of Gold for 150 ounces of Silver. Conversely, if the ratio declines to historically low levels, say 75, you could trade 150 ounces of Silver to acquire 2 ounces of Gold.

A simple Gold trading strategy that uses SMA, EMA and MACD indicators

Let us take a look at the 4-hour chart of Spot Gold (XAU/USD). For this trading strategy we have selected the following technical indicators:

- a 100-period Simple Moving Average (SMA)

- a 200-period Simple Moving Average

- a 15-period Simple Moving Average (red on the chart)

- a 5-period Exponential Moving Average (EMA) (black on the chart)

- the Moving Average Convergence Divergence (MACD) indicator with its default settings (short term – 12; long term – 26; MACD SMA – 9).

You should consider taking a long (buy) position in Gold, when:

there is a cross between the 5-period EMA and the 15-period SMA from below to the upside and the current candle has closed;

there is a cross between the two lines of the MACD as well.

Keep in mind that the MACD lines may cross either before or after the 5-period EMA intersects the 15-period SMA. You should refrain from entering the market if both crosses have not occurred. Always set a Stop Loss at the nearest support level, ensuring a minimum distance of 40 pips as a precaution against sudden, significant market moves. Close a long position only when both crosses appear in the opposite direction. If only one cross is present, maintain the position until the second cross confirms the trend reversal.

You should consider taking a short (sell) position in Gold, when:

there is a cross between the 5-period EMA and the 15-period SMA from above to the downside and the current candle has closed;

there is a cross between the two lines of the MACD as well.

Set a Stop Loss at the nearest resistance level, ensuring a minimum distance of 40 pips. The short position should only be closed when both crosses appear in the opposite direction. Additionally, avoid entering a trade if Spot Gold is trading within 25 pips of the 100-period Simple Moving Average or the 200-period Simple Moving Average.

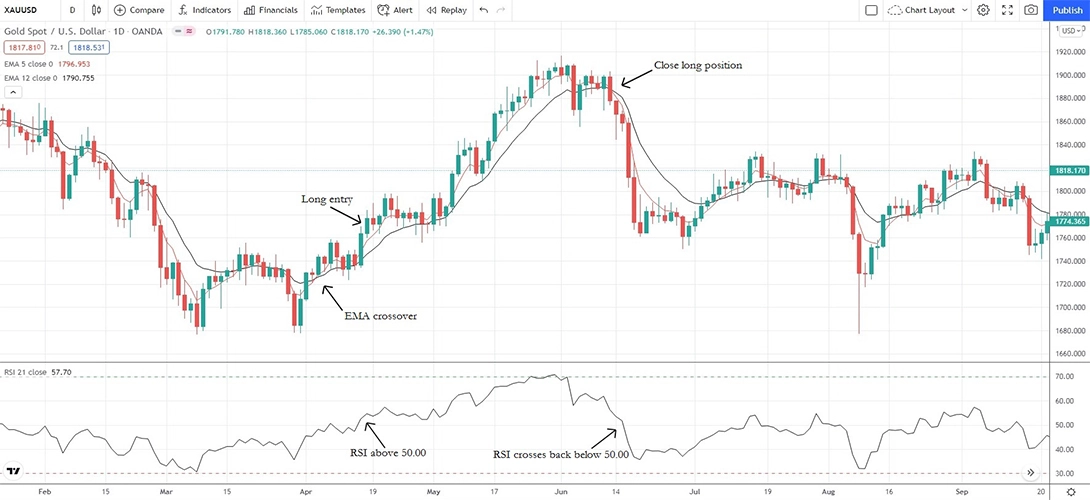

Another Gold trading strategy that relies on EMA and RSI indicators

In case you are short of time to closely follow Gold’s intraday price developments, then this strategy may be of some use to you. Let us take a look at the 1-day chart of Spot Gold. For this trading strategy we have selected the following technical indicators:

- a 5-day Exponential Moving Average (EMA) (red on chart)

- a 12-day Exponential Moving Average (black on chart)

- the Relative Strength Index (RSI) with a time period set to 21.

You should consider taking a long (buy) position in Gold, when:

there is a cross between the 5-day EMA and the 12-day EMA from below to the upside and

the RSI currently inhabits the area above 50.00.

You should exit your long position, when the two Exponential Moving Averages cross in the opposite direction (from above to the downside), or the RSI reading slips below the 50.00 level.

The chart below visualizes a long trade in Gold, based on this strategy.

You should consider taking a short (sell) position in Gold, when:

there is a cross between the 5-day EMA and the 12-day EMA from above to the downside and

the RSI currently inhabits the area below 50.00.

You should exit your short position, when the two Exponential Moving Averages cross in the opposite direction (from below to the upside), or the RSI reading surges above the 50.00 level.

Another Gold trading strategy that relies on EMA and RSI indicators

This time we will be examining the 30-minute and the 4-hour charts of Spot Gold. For this strategy we will be using the following technical indicators:

- Relative Strength Index (RSI) with a period set to 14, overbought level at 70.00 and oversold level at 30.00;

- Bollinger Bands with default settings.

The 50.00 level of the RSI will help determine whether Gold is trending upward or downward. Observing the 4-hour chart, if the RSI is above 50.00, Gold is in a bullish trend. Conversely, if the RSI is below 50.00, the market is in a bearish trend.

For market entries, we will refer to the 30-minute chart of Gold. In a bullish trend, if a candle closes below the lower Bollinger Band, focus on the following candle. If it closes above the lower band, this signals a potential long entry. The Stop Loss should be placed at the low of the candle that closed below the lower Bollinger Band.

If we are in a bearish trend and a candle closes above the upper Bollinger Band, we then focus on the following candle. Should it close below the upper band, this can be treated as a short entry setup. The Stop Loss should be placed at the high of the candle that closed above the upper Bollinger Band.

Conclusion

If you are a beginner, trading Gold through CFDs may be the most suitable option, as it is usually the most accessible and cost-efficient method. However, since CFDs carry a high risk of rapid capital loss due to leverage, it is essential to approach these derivatives with strict risk management, including proper position sizing and the use of all available risk tools such as Stop Loss, Trailing Stop, and Guaranteed Stop, alongside a clear trading plan.

Moreover, selecting an online CFD provider with strong regulation and a solid reputation is crucial. Doing so ensures you are dealing with a company that operates transparently and ethically. Conducting thorough research on different brokerages is always recommended before investing real funds and using any broker’s trading platform.

Finally, investing significant time in quality education is highly advised. Understanding the key factors driving the Gold market and developing the skills necessary for informed trading decisions will improve your ability to select trades wisely and manage your investment effectively.